Fiscal representation, customs and vat from a sales perspective

- 1. Customs & VAT From a sales perspective Michel de Haas, Group Customs & Trade Compliance Senior Manager

- 2. 2 | DSV – June, 2016 Scope We sell a wide scope of logistic solutions across the globe and once implemented the operation we have ongoing customs consequences; supplier end- customer supplier / distributor carrier port of arrival transport port of departure 1. From a duty point of view (levy, €) – fiscal 2. From an economic, a protection and a security point of view – non-fiscal

- 3. 3 | DSV – June, 2016 Scope Indirect taxation: • Import duties & related • Tax (VAT) • Excise Fiscal Duties VGEM : • Safety • Health • Economy • Environment Non-fiscal Duties Besides specific purpose also another means to control input, process and output streams. VB import , transit and export , import restrictions , quotas, product , counterfeiting, environmental requirements , flora and fauna etc.

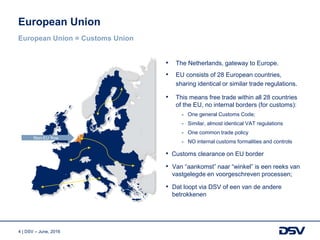

- 4. 4 | DSV – June, 2016 • The Netherlands, gateway to Europe. • EU consists of 28 European countries, sharing identical or similar trade regulations. • This means free trade within all 28 countries of the EU, no internal borders (for customs): - One general Customs Code; - Similar, almost identical VAT regulations - One common trade policy - NO internal customs formalities and controls • Customs clearance on EU border • Van “aankomst” naar “winkel” is een reeks van vastgelegde en voorgeschreven processen; • Dat loopt via DSV of een van de andere betrokkenen European Union European Union = Customs Union Non-EU flow

- 5. 5 | DSV – June, 2016 European Union Customs 1. Placing of goods under a customs procedure; • bring the scheme into free circulation • Transit • the customs warehousing procedure • inward processing • processing under customs control • temporary importation • outward processing • Export 2. Entry of goods into a free zone or free warehouse 3. Re-exportation from the customs territory of the EU 4. Destruction of goods port of arrival supplier / distributor transport end- customer

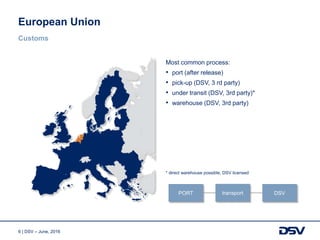

- 6. 6 | DSV – June, 2016 European Union Customs Most common process: • port (after release) • pick-up (DSV, 3 rd party) • under transit (DSV, 3rd party)* • warehouse (DSV, 3rd party) * direct warehouse possible, DSV licensed PORT transport DSV

- 7. 7 | DSV – June, 2016 Shipments of goods arriving in Europe: 1. Goods are cleared immediately (port) or semi-immediately, clearance on arrival 2. Goods are stored in bonded warehouse, clearance on outbound order 3. NO clearance at all, transit in Europe (bonded shipment/NCTS) - T-doc system, clearance and closing closely monitored on operational site-level for riskmanagement purposes Doing business in Europe

- 8. 8 | DSV – June, 2016 European Union Non-EU Sourcing Clearance upon arrival Free storage Or direct distribution Bonded storage Clearance on outbound Transit/ bonded export outside EU

- 9. 9 | DSV – June, 2016 • Customs clearance on arrival – using Sagitta/AGS system for electronic clearance and communication with Dutch Customs; • Customs clearance on outbound – (using bonded warehouse), fully automated in ‘GPA’ (= abbr. of automated periodic duty return). Monthly report and payment to Customs. Most of relevant information (a joint effort of customer and DSV) implemented in system. European Union Customs

- 10. 10 | DSV – June, 2016 Relevance for you: • Good inventory of what is asked, whether or not (timely) arming customs specialist ( e.g. using a questionnaire) • Realise that not always EVERYTHING ( equal) OR is possible that additional measures must be taken • We do - in principle – NOT do brokerage unless we have real prospects of transport and/or logistics • Cost -efficiency hinges on how customs information is supplied (loose, EFI, email, system downloads etc). European Union Customs

- 11. 11 | DSV – June, 2016 Regardless of the chosen clearance set-up (Sagitta/AGS or bonded warehousing/GPA), duties are based on three important elements: 1. CLASSIFICATION (HS code) and related tariff – Classification is based on the goods themselves, technical aspects, description, use 2. Customs VALUE – Value is transactional value, value according to first transaction into Europe, which includes price paid, costs of insurance, transportation until place of importation, paid commissions etc. 3. ORIGIN of the goods – Origin is important for use of proper (preferential) tariffs All three elements require close cooperation during initial setup and frequent monitoring when continuously using HS-coding and value for products. This is part of DSV’s internal control procedures. European Union Customs

- 12. 12 | DSV – June, 2016 Importation also triggers VAT (value added tax) because four main activities are actually VAT liable: 1. Import(s)* 2. Actual supply of goods* 3. Providing or rendering services 4. Intra-Community acquisitions (Netherlands 21 or 6 %, but in cross-border situations reversed charged / 0% …) * Foreign companies most common and regular activities Value Added Taxation VAT Is the Value Added Taxation on prices an entrepreneur charges to its customers for the supply of goods or for providing services

- 13. 13 | DSV – June, 2016 • System of VAT focuses on the VAT being charged to END-consumer • Companies importing and delivering to other (VAT registered) companies (B2B), may have VAT exemption, or VAT is charged but reclaimed • When selling to end-consumers (often private individuals or non-registered companies) VAT is being charged European Union The system in general 0% 0% 0% 0% 0% 23% 25%

- 14. 14 | DSV – June, 2016 European Union Standard transaction in supply chain, FOREIGN company fiscally represented, B2B Private individual Company 21% reverse charged, 0% Private individual Company Company 19% 19%, but refund Private individual 19% Germany Company Spain VAT 0% VAT 0% or VAT 0%

- 15. 15 | DSV – June, 2016 • A non-resident trader, not having a Dutch based company or permanent establishment/branch office, performing VAT taxed activities in the Netherlands (like import) should pay VAT on importation, unless the company appoints a fiscal representative. Only for companies using fiscal representation, VAT deferral on import (exemption) is available! • Advantage, doing business in Europe operating similar to a (residing) European company, by just selling from EU distribution centre storage, no corporate tax issues. Reduced lead times to customers, operate as a direct European competitor. • Non-resident trader has to meet (and to keep up with) all legislative and tax law requirements, but in order to do so, appoints a fiscal representative familiar with local law and legislation. • Fiscal representative takes care of VAT related administrative services and shares VAT responsibility with non-resident trader. The fiscal representative provides guidance in EU VAT requirements and supports administrative process. A non-EU resident trader

- 16. 16 | DSV – June, 2016 A non-EU resident trader • For import and subsequent transaction only • No own registration (you use DSV’s VAT#) • Application of VAT deferral system at importation • Authorisation from tax authorities • Authorisation from client • Liability of limited fiscal representative is unlimited • Guarantee to LFR (unless decided differently) • For import, intra-Community acquisitions and sales to private individuals • Own VAT registration • Guarantee to authorities • Application of VAT deferral system at importation • Authorisation from tax authorities to general fiscal representative • Authorisation from client to general fiscal representative • Liability of general fiscal representative is limited to the amount of the guarantee Two options to choose from General fiscal representativeLimited fiscal representative

- 17. 17 | DSV – June, 2016 Customs Services & Fiscal Representation 1 An effective and efficient supply chain; 2 Having the lead on all aspects, including delivery; 3 Strenghtening relation with customer; 4 Better market position as competitor; 5 Better leadtimes (no delay in administrative process); 6 Acting as a ‘EU company’ 7 Better inventory management (a smooth operation may increase more frequent ordering, reducing inventory levels for customer); 8 Exempted VAT on import, cashflow benefit; 9 In case of fiscal representation NO handling, administrative burden i.e. extra costs for customers What is in it for non-EU suppliers?

- 18. Doing business in Europe Business to Consumer (B-2-C)

- 19. 19 | DSV – June, 2016 VAT - European Union Business to Consumer – B2C

- 20. 20 | DSV – June, 2016 Distance selling in the EU occurs when a supplier in one EU member state (for instance from a DSV Solutions warehouse in the Netherlands) sells goods to a person in another member state who is not registered for VAT (mostly private individuals) and the supplier is responsible for the delivery of the goods. You can think of mail order sales or goods ordered over the internet . Under the distance selling arrangements, sales to customers in other member states who are not registered for VAT are liable to VAT in the Member State of the supplier provided that the (turnover) threshold appropriate to the Member State of the customer is not breached. Where sales exceed the threshold in any particular Member State, the supplier must register and account for VAT in that particular Member State. Apart from the demanding logistics in this (retail) supply chain, DSV – in co-operation with a business partner – offers a solution for ‘unburdening’ Distance sales in the EU What is distance selling? B2B = sales to VAT registered companies, distributors B2C = sales to private individuals

- 21. 21 | DSV – June, 2016 European Union - Normal VAT regulations Standard transaction in supply chain, B2B Private individual reverse charged, 0% Company Germany Company SpainNetherlands VAT 0% VAT 0% or VAT 0%

- 22. 22 | DSV – June, 2016 European Union - Distance selling VAT regulations Transactions with private individuals, B2C 21% 21% Private individual Private individual 21% Germany Spain Private individual Netherlands Private individual Private individual 21% 21% Invoices to Dutch consumers with 21% Dutch VAT !! VAT reporting in Netherlands for import, B2B and Dutch consumers !!

- 23. 23 | DSV – June, 2016 European Union Distance Selling €35,000 €35,000 €100,000 £70,000 €35,000 SEK320,000 €35,000 €35,000 €35,000 BGN 70,000 RON 188,000 €35,000 €35,151 LVL24,000 LTL125,000 PLN160,000 €100,000 CZK1,140,000 €35,000€35,000 DKK280,000 HUF8,800,000 • European Union, thresholds • Exceeding thresholds = VAT applicable of country of destination

- 24. 24 | DSV – June, 2016 European Union Transactions with private individuals B2C (AFTER exceeding thresholds) 21% 19% Private individual Private individual 21% Germany Spain Private individual Netherlands Private individual Private individual Invoices to Dutch consumers with 21% Dutch VAT VAT reporting in NL for import, B2B & Dutch consumers Invoices to German consumers with 19% German VAT VAT reporting in Germany for German B2C Invoices to Spanish consumers with 21% Spanish VAT VAT reporting in Spain for Spanish B2C By DSV By third party, but data to be provided by DSV By third party, but data to be provided by DSV VAT registration VAT registration

- 25. 25 | DSV – June, 2016 1. Initial setup / contract / bond; who is importer of record SETUP fee , monthly fee 2. Compliance – a.o. invoicing requirements 3. INCO terms 4. Direct shipments (passing by NL’s), B2C issues 5. Verhuizingen (stock-movements) 6. NL is rapidly losing VAT deferral advantages ... From Practice…

- 26. 26 | DSV – June, 2016 7. GFR better than LFR AND threshold to LFR feels, given security is almost gone ; 8. GFR can never duplicate and therefore not a " takeover " GFR (for example, two service with GFR is impossible) 9. GFR LFR can possibly be ( two service BUT administratively complex and risky in case of identical goods ) 10.LFR may double ( two service BUT administratively complex and risky in case of identical goods ) From Practice…