121010_Mobile Banking & Payments for Emerging Asia Summit 2012_Introducing Visa Mobile Payments for Developing Countries

- 1. Introducing Visa Mobile Payments for Developing Countries Examining User Experience and Its Impact on Adoption & Usage of Mobile Channels – Visa Mobile for Developing Countries Mobile Banking & Payments for Emerging Asia Summit 2012 Prepaid and Emerging Markets | April 2012

- 2. Forward-Looking Statements • These materials and discussion of them may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified by the terms “anticipate,” "believe," "continue," "could," "estimate," "expect," "intend," "may," "potential," "project," "should," "will" and other similar references to the future. • Examples of such forward-looking statements may include, but are not limited to, statements we make about our response to the recent U.S. financial regulatory reform legislation, the effect of developments in regulatory and government investigations, our future strategic plans and goals, our pricing strategies, our data processing revenues, the number of transactions we process, our belief that there will be a global secular shift to electronic payments and our growth in that category, increased consumer and commercial spending, our liquidity needs and our ability to meet them, and our online payment, fraud and security management capabilities. • By their nature, forward-looking statements: (i) speak only as of the date they are made, (ii) are neither statements of historical fact nor guarantees of future performance and (iii) are subject to risks, uncertainties, assumptions and changes in circumstances that are difficult to predict or quantify. Therefore, actual results could differ materially and adversely from those forward-looking statements because of a variety of factors, including the following: • The impact of the U.S. Wall Street Reform and Consumer Protection Act, including: its effect on issuers' and retailers' network selection for debit transactions; its effect on our financial institution customers and on debit interchange rates; its effect on other product categories, such as credit; and the adoption of similar and related laws and regulations elsewhere; • Developments in current or future disputes, including: interchange; currency conversion; and tax; • Macroeconomic and industry factors such as: currency exchange rates; global economic, political, health and other conditions; competitive pressure on customer pricing and in the payments industry generally; material changes in our customers' performance compared to our estimates; and disintermediation from the payments value stream through government actions or bilateral agreements; • Systemic developments, such as: disruption of our transaction processing systems or the inability to process transactions efficiently; account data breaches involving card data stored by us or third parties; increased fraudulent and other illegal activity involving our cards; failure to maintain interoperability between our and Visa Europe's authorization and clearing and settlement systems; loss of organizational effectiveness or key employees; changes in accounting rules or treatment; and • The other factors discussed under the heading "Risk Factors" herein and in our most recent Annual Report on Form 10-K and our most recent Quarterly Reports on Form 10-Q. • You should not place undue reliance on such statements. Unless required to do so by law, we do not intend to update or revise any forward-looking statement, because of new information or future developments or otherwise. Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 2

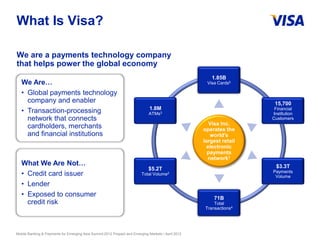

- 3. What Is Visa? We are a payments technology company that helps power the global economy 1.85B We Are… Visa Cards5 • Global payments technology company and enabler 15,700 1.8M • Transaction-processing ATMs3 Financial Institution network that connects Customers Visa Inc. cardholders, merchants operates the and financial institutions world’s largest retail electronic payments network1 What We Are Not… $3.3T $5.2T • Credit card issuer Total Volume2 Payments Volume • Lender • Exposed to consumer 71B credit risk Total Transactions4 Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 3

- 4. Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 4

- 5. Snapshot America – circa 1958-1959 Financial Account Acceptance Sources: Electronic Value Exchange – Origins of the VISA Electronic Payment System by David L. Stearns; The Power of an Idea by Paul Chutkow Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 5

- 6. US Credit Card Market: 1958-1966 1958-1959 1960-1966 Bank AmeriCard and Only 10 more 30 other closed-loop closed-loop programs launched programs added 45 # of bank-led credit card programs (USA) 40 35 30 25 20 15 10 5 0 1958 1959 1960 1961 1962 1963 1964 1965 1966 Year Sources: Electronic Value Exchange – Origins of the VISA Electronic Payment System by David L. Stearns; The Power of an Idea by Paul Chutkow Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 6

- 7. Three years later… 3 More Years 1400 # of bank-led credit card programs (USA) 1,207 1200 1000 1958-1959 800 BofA + 30 more 600 1960-1966 Just 10 more 481 400 200 0 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 Year ? Sources: Electronic Value Exchange – Origins of the VISA Electronic Payment System by David L. Stearns; The Power of an Idea by Paul Chutkow Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 7

- 8. 1966: from closed to open networks Financial Account Acceptance Shared Networks Sources: Electronic Value Exchange – Origins of the VISA Electronic Payment System by David L. Stearns; The Power of an Idea by Paul Chutkow Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 8

- 9. Emerging markets and inclusive finance What’s different • Technology • Regulation • Partners • Applications What’s not • The power of shared networks Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 9

- 10. Déjà vu? Financial Account Acceptance Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 10

- 11. Economies of scale through interoperability Financial Account Acceptance Shared Network Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 11

- 12. Visa is a Network Business • Banks and Mobile Network Operators come from the same DNA. Both run network businesses – one moving dollars and cents, the other voice and data. • Visa connects the world through digital currency and financial services • Visa continues to innovate globally and lead in payments and payment solutions whilst working with many partners in the global eco-system Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 12

- 13. Convergence of Networks Mobile Credit Web Debit Social Prepaid Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 13

- 14. Serving Consumers in Developed and Developing Countries Mature Countries Enhances consumer payment experience, offers consumers more control and a way to better manage financial accounts. Developing Countries For billions of people considered unbanked, simplify access to financial services, bring more security and global reach to daily financial transactions Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 14

- 15. Developed Countries: Next Generation Payment Solutions Sophisticated, Cross-Channel Digital Wallet • “Mobilize” existing Visa accounts * • Extend mobile banking to payments • Enhance consumer payment experience • Enable consumer control • Offer new transaction types Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 15

- 16. Developing Countries: Next Generation Payments Solutions A Mobile Wallet for Developing Markets • Increase financial inclusion for millions of unbanked • Visa virtual prepaid as onramp to financial services • Drive global interoperability, scalability and security • Enable consumer control • Offer new payment types Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 16

- 17. From Closed to Open Loop…. New Payment Functionality • 15K financial institutions • eCommerce Mobile Stored • Millions of Value Account merchants • International remittances • 1.9 billion Visa Perso accounts • ATM & EDC Closed- n-to- Loop Perso Withdrawals Global Mobile n Interoper- Prepaid Security ability Cash-in / Agent • 200 countries out Network • Real-time risk • 175 currencies scoring • 20,000 transaction • Fraud and dispute messages p/sec. Scalability management • Multiple security layers Mobile Money APAC 2012, Singapore, 30th January Mobile Banking & Payments for Emerging Asia Summit Visa Mobile Prepaid and Emerging Markets | April 2012 2012 Prepaid and Emerging Markets | April 2012 Visa Confidential 17 2012

- 18. Terima Kasih! [email protected] Mobile Banking & Payments for Emerging Asia Summit 2012 Prepaid and Emerging Markets | April 2012