Understanding and Making the Most of Business Angels (Alan Barell)

- 1. Understanding and Making the Most of Business Angels 29th August 2006 Professor Alan Barrell Tallin CONNECT Seminar

- 3. Stay Cool! Dilbert - Scott Adams

- 4. Stay Cool! Dilbert - Scott Adams

- 5. Stay Cool! Dilbert - Scott Adams

- 6. Venture Capital Investments in E- Commerce (U.S.A.) Total Invested ($ million) Number of Companies 600 $6,000 500 $5,000 400 $4,000 300 $3,000 200 $2,000 Netscape IPO 100 3rd largest in Amazon.com IPO $1,000 Nasdaq History 0 $0 94 95 96 97 98 99 Source: Venture Economics Number of Companies Total Invested

- 11. Building Tomorrow’s Businesses – Culture, Mindset and The Columbus Spirit My ‘3i s’ • Inspiration • Invention • Implementation So remember -the Columbus Spirit?

- 12. Mind of an Entrepreneur “You look at things and ask - why? but I dream of things that never were and ask - why not?” George Bernard Shaw

- 14. Joseph Schumpeter (1911) “Entrepreneurs blow gales of creative destruction.” Role of the entrepreneur in transforming economies by developing: • New products • New methods of production • New ways of organizing • Untapped raw materials • Enhanced competitive performance

- 15. Financing Tomorrow’s Businesses Where to go for early stage money – there is plenty of it around ! The Bank Corporate Venturers Government Grants Family and friends Seed Funds The local Pub Venture Capitalists Business Angels 2

- 16. Sources Of Business Finance “Our Money” “Our Money” B Family and Friends Family and Friends A N Business Angels Business Angels K Seed Funds Seed Funds Risk F I Early Stage VC Early Stage VC N A Expansion Capital Expansion Capital N C E Pre-IPO Pre-IPO ?? Maturity

- 17. Sources Of Business Finance 1) “Our Money” - Our decisions - no strings 2) Family and Friends - Few strings, great faiths 3) Business Angels - Money “plus” - use my expertise 4) Seed Funds - Support proof of principle 5) Early Stage - Management support - experience 6) Expansion - Lower level of support - but experience of business development 7) Pre-IPO - Opportunistic 8) Banks - Not risk takers – can be helpful

- 18. Stages Of Investment (1) 1. Seed Developing IPR, unlikely to have full time employees, and may well have no business premises. Working on “proof of principle” 2. Start up Companies in the process of being set up, with limited trading. Involved in product development and initial marketing 3. Early stage Companies that have completed the “proof of principle”, own some IPR, have a management team substantially in place, requiring funds for manufacturing and/or licensing, and sales

- 19. Stages Of Investment (2) 4. Expansion Established companies, with a full management team and generating sales, and require further finance to break into new markets. The definition “Expansion” often creates confusion 5. Pre IPO Final round prior to a listing on a recognised Stock Exchange. Can be referred to as “Expansion” funding 6. Later stage Many variants – M and A, MBO, MBI etc.

- 21. Finding Your Angels • Networking, Networking, Networking! • Research and Knowledge • Investment Criteria • Lone or “Choirs” of Angels • Angel Connections and Expertise • Personal Chemistry • Active or Passive • Track Record and Referrals

- 22. How do we IMPRESS our Angels? • Very clear Business Model and Plan • “Show me the MONEY” • Clarity and attractiveness of Presentation • Integrity • Answers to Questions • Asking the right Questions • Believable People and Teams • Ideas on building a coherent Board – including Investor Directors

- 23. Engaging The Funders • Preparing the case - how to start -”Do we need help ?” - Intermediaries-Corporate Finance. • Is the Business Model Clear? • Keep Business Plans Simple! • Targeting funders - Investors have specific criteria • ?Angels, Banks, Seed Fund, Corporates or VCs – or a “mix” • Matching agendas • Sponsors for spin-outs • Organisations and people - the forward plan

- 24. Great Eastern Investment Forum Started in April 1994 Membership of 500 plus Three presentation days a year - 8 companies at a time. Also publishes “Link-Up” and “online” at www.geif.co.uk 1,000- plus companies seen. 250 plus presented. “Hit rate” of 40% Total funds raised is £50 million Govt. money augments Angel Money – Small Business Growth Fund – and Enterprishe Challenge Fund 4

- 25. Other Cambridge Angels • Cambridge Angels - Very High Net Worth ( HNWIs ) - Dining Club Format Each Group is approx 40 - Little Formal Structure members – No fund - - “Heavy Hitters” Individual investment decisions. • Cambridge Capital Group - “Distant Angels” - “Absent Angels” - “Passive Angels”

- 26. Financing Tomorrow’s Businesses- including spin-outs – Angel Virtues • Technical Expertise • Marketing Expertise What else you get • Contacts from Business • Decision Making skills Angels…. • Presentation skills • Dealmaking skills • Money-raising skills • Other Financial skills • Possible exit routes and practical help with exit 7

- 27. US Angels – The REAL early stage funders ! • In 2000 US business Angels invested more than $200billions in early stage companies • This was much more than the so called “venture capital industry” which did not reach investment levels that year of $150 billions. • In the difficult year of 2002 – when VCS “sat on hands” – Cambridge Angels kept the early stage and emerging business sector alive and well • Cambridge Angels are adopting the US success model and working more closely together.

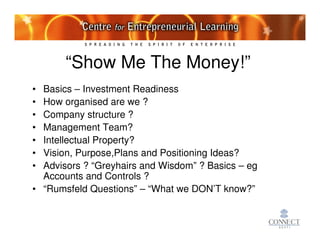

- 29. “Show Me The Money!” • Basics – Investment Readiness • How organised are we ? • Company structure ? • Management Team? • Intellectual Property? • Vision, Purpose,Plans and Positioning Ideas? • Advisors ? “Greyhairs and Wisdom” ? Basics – eg Accounts and Controls ? • “Rumsfeld Questions” – “What we DON’T know?”

- 30. “Show Me The Money!” • Understanding the “Money Supply Chain” • Research and Help – and where to find it • What’s Best for Our Business ? • “Money on its own may not bring the Value you need” • Friends, Banks, “Angels”, VCs et al. • Grants – including DTI R & D Grants • Resourcefulness, Resilience and Recovery” • Learning from encounters with investors • Attention to detail – “nitty gritty” • Understanding how Angels may ( or may not ) work with later investors – such as VCs

- 31. Financing Tomorrow’s Businesses- including spin-outs • Technical Expertise • Marketing Expertise What else you get • Contacts from Business • Decision Making skills Angels…. • Presentation skills • Dealmaking skills • Money-raising skills • Other Financial skills • Possible exit routes and practical help with exit 7

- 32. Due Diligence is a two way thing: • Investors due diligence agenda:- – Technology and I.P. – Market - is it really there? – People - can they do it? – Exit options and drive • Due Diligence on Investors:- – Investment criteria – Track record – People, relationships, references – Clarity of expectations – Available finance - including “follow on” – Willingness to syndicate and to participate

- 33. Structuring The Deal • Selecting advisors • Aligning Shareholders/Investors • Offers and Agreements • Leaving space for future financing rounds • Business strategy and Exit options • Valuation

- 34. Valuation – how and why • To indicate value to potential investors • What is a company worth? - What someone will pay for it • What is this determined by? - Other investment choices

- 35. A Search for Fair Value Issue date On issue 1 Year On Bookham April 2000 £1.2 £231 billion million Lastminute.c March £571 £54 om 2000 million million Orchestream June 2000 £212 £52 million million Just2clicks Feb 2000 £130 £- million

- 36. Case Study: Antenova – a funding fable • Disruptive technology which could change the world – from University collaboration • Outstanding management – technical and operations • Inexperienced in fundraising • Valuation obsession • Where has all the money gone? • Salvation, adequate funding and continued progress

- 38. Show Inspiration! Investors have emotions! “Excellence can be achieved, if we: Care more than others think is wise, Risk more than others think is safe, Dream more than others think is practical, Expect more than others think is possible.” Deborah Johnson-Ross

- 41. In Pursuit of Excellence ! “Excellence can be achieved, if we: Care more than others think is wise, Risk more than others think is safe, Dream more than others think is practical, Expect more than others think is possible.” Deborah Johnson-Ross

- 42. Be Visionary ! More information at…. [email protected] www.alanbarrell.com