Dutch Media Landscape 2017 Q1 update by Starcom

- 1. 1

- 2. 2 WHAT’S NEW Q1 2017 Instagram and Netflix keep on growing; they both enter top 10 apps based on reach. Positive figures market share TV for NPO (in particular NPO 1). New players within traditional TV landscape such as VICELAND and among online streaming services (Amazon Prime). Millennials watch 3 hours more online video per day than 55+. Increasing trend of cinema visitors continues in Q1 2017. Radio channels 3FM and BNR Nieuwsradio lost ground in terms of gross media spend. Blendle shapes online reading landscape by launching monthly subscription option Despite critical market, newspapers AD and De Volkskrant show significant increase in gross media spend. Instagram has highest increase in active users, Whatsapp and Facebook keep growing as well. YouTube is making progress towards people based marketing by avoiding cookies and pixels more. The outdoor rights of ‘RET’ (public transport Rotterdam) are granted to JCDecaux which benefits their position in the OOH landscape.

- 3. 3 Starcom is the Human Experience Company. At Starcom we believe that experiences are the new communication currency. Experiences enrich lives and facilitate connections between brands and consumers. To create the right experience, understanding people is key. We need to understand our clients’ target audiences throughout the whole marketing funnel. Within this funnel, consumer media behavior plays a very important role. That’s why we no longer divide the media landscape based on media types, but on how people experience media. As such, we differentiate between five key Media Consumption Patterns (MCPs): Watching, Listening, Reading, Communicating and On the Go. Based on these MCPs we will guide you through the Dutch media landscape. We hope you will enjoy it. MEDIA PHILOSOPHY

- 4. 4 In The Netherlands Starcom is part of Publicis One. Publicis One is a house of brands consisting of twelve labels in media, creative, technology, data & production. We work together in multidisciplinary teams and from one P & L. Customers have access to all our specialized labels, expertise and tools, and we provide them with the best integrated brand, media and (digital) communications solutions at local and international level. This will result in higher quality, speed and costs for our customers.

- 5. 5

- 6. 6 Watching Listening Reading Communicating, Social Media, Surfing online Overall media and consumer stats & figures On the go Appendix The Netherlands: general stats & figures CONTENT

- 7. 7 THE NETHERLANDS general stats & figures

- 8. 8 Dutch population is still growing and getting older. The number of households has grown with 8% since 2006, mostly due to the increasing number of single person households (+16%). 2.502 2,906 4.644 4,815 2,26 2,17 1,0 1,3 1,6 1,9 2,2 2,5 0 2.000 4.000 6.000 8.000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Averageno.peopleinHH #HH(in‘000s) Household (HH) size Single person household Multiple person household Average no. of people in HH Source: CBS, Statline, 2016. 16.334 16.979 16.000 16.200 16.400 16.600 16.800 17.000 17.200 Duizenden Population (in ‘000) 39,2 41.5 38 39 40 41 42 Average age 28,3 29,0 29,4 30,6 32,6 33,1 33,3 33,2 33,3 33,3 33,6 34,2 34,1 25 30 35 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 €(in‘000s) Annual disposable HH income

- 9. 9 In 2017 Q1 the Dutch consumer confidence index increased to 124, which is the highest level in at least 10 years and indicates optimism. Source: CBS, Statline, 2016 Source: Nielsen Consumer Confidence, Q4 2016 Consumer confidence worldwide – Q4 2016 -50 -40 -30 -20 -10 0 10 20 30 2008Jan 2008Apr 2008Jul 2008Oct 2009Jan 2009Apr 2009Jul 2009Oct 2010Jan 2010Apr 2010Jul 2010Oct 2011Jan 2011Apr 2011Jul 2011Oct 2012Jan 2012Apr 2012Jul 2012Oct 2013Jan 2013Apr 2013Jul 2013Oct 2014Jan 2014Apr 2014Jul 2014Oct 2015Jan 2015Apr 2015Jul 2015Okt 2016Jan 2016Apr 2016Jul 2016Okt 2017Jan Difference%positivevsnegativeanswers Dutch consumer confidence

- 10. 10 Unemployment has dropped between 2014 and 2016 but that trend is, just like purchasing power, expected to come to a halt in 2017. Key Economic Indicators NL 2011 2012 2013 2014 2015 2016 2017** Inflation 2.3% 2.5% 2.6% 0.3% 0.2% 0.1% 0.9% Economic growth 1.2% -1.7% -0.5% 1.0% 2.0% 1.7% 1,6% Purchasing power* -1.0% -1.9% -1.3% 1.3% 1.1% 2.7% 0.7% Unemployed (in ‘000s) 389 469 647 660 614 555 560 Unemployment % 5.4% 5.3% 7.3% 7.4% 6.9% 6.2% 6.2% Source: CPB, Kerngegevenstabel 2012- 2015 and 2014-2017, August 9th 2016 (* median for all households; ** estimated figures)

- 11. 11 OVERALL media and consumer stats & figures

- 12. 12 Everything is SoLoMo nowadays Social Social media connects people worldwide with events, activities and each other Local Increasing ability for brands and organizations to respond to people’s whereabouts and out-of-home activities Mobile Mobile technology makes it possible to reach people anywhere, anytime Source: SMG Human Experience Strategists Center

- 13. 13 TRENDS

- 14. 14 10 global trends for consumers in 2017 Ageing: A changing narrative In 2017, almost a quarter of everyone on the planet will be over the age of 50, a record. These consumers will be older in terms of lifestyle and are more demanding in their consumptions needs (Longevity Economy). Consumers in training Today’s family demands are launching youngsters into consumption at an earlier stage. Increasingly, the input of children in purchasing decisions is welcomed by their parents, rather than being perceived as a nuisance. Extraordinary We have reached a point when mass-produced items have lost some of their shine. The internet is enabling consumers to purchase and discuss the “long tail” – unique, customized and exotic products and services. Faster shopping In 2017, consumers are impatient. The digital world has schooled more of them into becoming so-called “IWWIWWWI”: “I want what I want when I want it”. Get real: The allure of authenticity Authenticity is a standout consumer value in 2017, heralded by everyone from change makers and celebrities to supermarkets and chefs. Identity in flux The nature of identity itself is in flux with a more elastic understanding of ethnicity and gender. Brands need to rethink who their audiences really are. Personalize it In 2017, we will have come to accept the idea that an industrially-produced product can be customized or personalized, at least in part. Post-purchase In 2017, shoppers will be paying more attention to their post-purchase experience, becoming a more important part of the consumer journey. Privacy and security In our volatile world there is more focus is on personal safety and that of loved ones which results in greater leaning towards home and mobile cocooning. Wellness as status symbol The desire to be fit and healthier seems to be almost universal. Healthy living is becoming a status symbol, as more consumers opt to flaunt their passion for it. Source: Euromonitor International Top 10 Global Consumer Trends for 2017.

- 15. 15 10 digital trends to watch in 2017: I Artificial Intelligence will not (yet) put marketers out of work Internet users still will not change their behaviors despite hacking scares Sometime in 2017, a live video will win a primetime-sized audience Chatbots are upcoming but will not yet become the reality 2017 will be the year of authetically mobile experiences Source: eMarketer Key Digital Trends for 2017, Dec 2016 Artificial Intelligence Privacy Live video Chatbot Mobile

- 16. 16 10 digital trends to watch in 2017: II Online grocery shopping will jump in 2017 Marketers will make the move to more complex forms of attribution modeling 2017 will be the tipping point for mobile messaging apps Influencers will take a significant chunk of the ad market in 2017 VR will not be a significant marketing channel until hardware becomes more widespread Source: eMarketer Key Digital Trends for 2017, Dec 2016 Online food shopping Modeling analysis Mobile messaging Influencers Virtual Reality

- 17. 17 5 mobile trends for 2017 VR technology transforms everyday interactions and offers brands a more personal customer service channel Image recognition creates seamless shopping and opportunities for personalization With the use of chatbots, people move to non- human interaction for simple tasks Robots enter the consumer journey and can help brands by providing services Companies are turning focus toward Generation Z using mobile behavior patterns to design relevant services Source: MWC Mobile Trends 2017 Virtual Reality Image recognition Chatbots Robots Generation Z

- 18. 18 Four important Entertainment & Media shifts which will determine the future of the Dutch media landscape Companies are transforming their business models and redefining their position in a changing landscape. These innovations are reflected in a further increase of digital Entertainment & Media spend, and a decrease in non-digital spend. The way media is consumed and is expected to develop differs crucially between age groups; e.g. born before/ after 1964. The younger audience will focus even more on digital media whereas the older audience will continue to spend most time and money on traditional media. Also in the Netherlands, digital giants like Google, Facebook and Apple are leading in the digital landscape. In order to survive in media it requires: owning a unique asset, providing a niche offering or fully embracing the change created by these giants. Shift 1 Business models Shift 2 Demographics Shift 3 Competition The growth of the Internet provides consumers with more options than ever. The willingness to shop online will continue to change how people spend their time and how companies make money. Shift 4 Consuming media Source: PWC Entertainment & Media Outlook forecast for The Netherlands 2016-2020

- 20. 20 Competitive reporting in the Netherlands Competitive reporting is based on gross media spend. Bear in mind that most advertisers profit from (heavy) discounting, especially on TV, so the difference with actual spend can be significant. In the gross spend reporting digital spend is not fully reported. For example, search, social media advertising and video are (partially) excluded. Source: Gross spend: Nielsen, 2016 | Net spend: Nielsen jaarrapport Netto Media Bestedingen 2016 | Note: For digital only net spend is available. 0 1.000 2.000 3.000 4.000 Cinema Newspapers Online Out Of Home Magazines Radio TV €millions Media spend 2016 Gross Net

- 21. 21 Decrease in gross media spend between 2016 and 2015 (excluding digital spend). Stable spend level in 2017 Q1. 0 1.000 2.000 3.000 4.000 5.000 6.000 7.000 8.000 €millions Gross media spends Source: Nielsen, 2012 – 2017 Q1 | Note: digital spend not included. +3,1 % YoY +4,9% YoY -1,1% YoY -5,3% YoY -0,3% YoY

- 22. 22 After a substantial decline for newspaper spend between 2015 and 2016, spend levels seem to stabilize in Q1 2017. 0 1.000 2.000 3.000 4.000 Cinema Newspapers Direct Mail Door Drops Out Of Home Consumer Magazines Radio TV Trade Press €millions Gross media spend per medium type across time 2013 2014 2015 2016 2016 Q1 2017 Q1 Source: Nielsen, 2012 – 2017 Q1 | Note: digital spend not included.

- 23. 23 In contrast to the last few years, in Q1 2017 share of spend of newspapers has increased and share of spend for TV has decreased. Source: Nielsen, 2012-2017 Q1 | *Note: digital spend is not included. 18% 17% 16% 16% 11% 13% 15% 7% 7% 6% 4% 3% 4% 5% 2% 2% 2% 2% 2% 2% 2% 7% 7% 7% 7% 7% 8% 8% 7% 7% 6% 6% 6% 5% 6% 9% 10% 10% 11% 12% 12% 12% 48% 48% 52% 53% 57% 55% 52% 1% 1% 1% 1% 1% 1% 1% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2012 2013 2014 2015 2016 2016 Q1 2017 Q1 Media mix Trade Press TV Radio Consumer Magazines Out Of Home Door Drops Direct Mail Newspapers Cinema

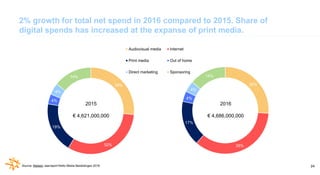

- 24. 24 2% growth for total net spend in 2016 compared to 2015. Share of digital spends has increased at the expanse of print media. Source: Nielsen Jaarraport Netto Media Bestedingen 2016 26% 35% 17% 4% 4% 14% 26% 32% 19% 4% 4% 14% Audiovisual media Internet Print media Out of home Direct marketing Sponsoring 2015 € 4,621,000,000 2016 € 4,686,000,000

- 25. 25 Spend of online advertising increased by 11% in revenue in 2016 41% 14% 45% Display Classifieds Search Total online ad spend 52% 16% 18% 14% Embedded Other & text links Video Interruptive Online display spend Source: Deloitte & IAB. Nederland, IAB Report on Online Advertising Spend, The Netherlands 2016, December 2016 2016: 1,683 m€ 2015: 1,512 m€ 2016: 683 m€ 2015: 615 m€

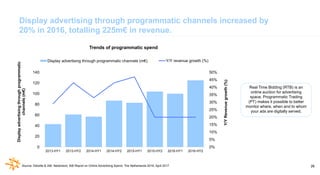

- 26. 26 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 0 20 40 60 80 100 120 140 2013-HY1 2013-HY2 2014-HY1 2014-HY2 2015-HY1 2015-HY2 2016-HY1 2016-HY2 Y/YRevenuegrowth(%) Displayadvertisingthroughprogrammatic channels(m€) Trends of programmatic spend Display advertising through programmatic channels (m€) Y/Y revenue growth (%) Real Time Bidding (RTB) is an online auction for advertising space. Programmatic Trading (PT) makes it possible to better monitor where, when and to whom your ads are digitally served. Source: Deloitte & IAB. Nederland, IAB Report on Online Advertising Spend, The Netherlands 2016, April 2017 Display advertising through programmatic channels increased by 20% in 2016, totalling 225m€ in revenue.

- 27. 27 11% 13% 16% 16% 18% 17% 16% 18% 17% 15% 13% 14% 54% 55% 55% 52% 2013 2014 2015 2016 Allocation of display revenue per format Video Text links/Other Interruptive Embedded (e.g. banners) Video and rich media formats show growth over the last years. Share of spend of banners slightly decreased but remains popular. Source: Deloitte & IAB. Nederland, IAB Report on Online Advertising Spend, The Netherlands 2016, April 2017

- 28. 28 Growth in total net media spend will mainly be a result of a significant rise in online spend. Print spend is expected to further decrease. 3.967 3.770 3.649 3.730 3.773 3.821 3.877 3.959 3.400 3.600 3.800 4.000 2011 2012 2013 2014 2015 2016 2017 2018 €millions Forecast net spend 0,8% -5,0% -3,2% 2,2% 1,2% 1,3% 1,5% 2,1% -6% -3% 0% 3% 6% Forecast net spend Change (%) to previous year - 500 1.000 1.500 2.000 2.500 Newspapers Magazines TV Radio Cinema Outdoor Internet €millions Net spend per medium type 2011 2012 2013 2014 2015 2016 2017 2018 Source: ZOG Adspend Forecast Netherlands – December 2016 (1980-2018)

- 29. 29 Top 10 advertisers in Q1 2017 is dominated by FMCG and retail Source: Nielsen, Q1 2017 | Note: gross online spend not included No. Advertiser Category Gross spend Q1 2017 1 Unilever Nederland Rotterdam FMCG €24,479,789 2 Procter & Gamble Nederland Rotterdam FMCG €22,901,254 3 Corendon International Travel Travel €21,192,478 4 Renault Nederland Schiphol-Rijk Automotive €20,725,256 5 A.S. Watson Europe FMCG €20,004,224 6 Vodafone Maastricht Telecom €16,380,283 7 Lidl Nederland Huizen Retail €14,591,494 8 Albert Heijn Zaandam Retail €14,278,302 9 Jumbo Supermarkten Veghel Retail €14,094,758 10 Reckitt Benckiser Nederland Hoofddorp FMCG €12,991,361

- 30. 30 Top 10 brands in Q1 2017 is dominated by supermarket chains Source: Nielsen, Q1 2017 | Note: gross online spend not included. No. Brand Category Gross spend Q1 2017 1 Corendon Travel €19,492,146 2 Kruidvat Retail €17,937,905 3 Lidl Retail €14,591,494 4 Jumbo supermarkten Retail €14,094,758 5 Albert Heijn Retail €13,998,700 6 Renault Automotive €12,668,859 7 Vodafone Telecom €10,302,059 8 Nationale postcode loterij Lottery €10,078,202 9 KPN Telecom €10,026,471 10 Vriendenloterij Lottery €8,997,199

- 31. 31 Total sponsor spend and average sponsor spend slightly decreased Total spend top 100 sponsors 2015 2016 Index Total sponsor spend €283,775,000 €274,255,000 97 Average sponsor spend (per brand) €2,837,750 €2,742,550 97 - 100 200 300 400 500 600 Sports Art & Culture Lifestyle Society Media (non-spot) €millions Sponsor spend by type of sponsorship 2010 2011 2012 2013 2014 2015 2016 Source: SponsorMonitor 2016 (Spend is an estimate based on input provided by advertisers. Only direct sponsor budget is included; any activation budget is excluded.)

- 32. 32 56% 14% 2% 10% 18% Sponsor contracts Sports Art & Culture Lifestyle Society Media (non-spot) In 2016, 283 new (and renewed) sponsorship contracts were signed. This implies a decrease of 42 contracts compared to 2015. The total value of all contracts in 2016 was €230,000,000, averaging €812,720 per contract*. Both the total and the average increased substantially compared to 2015 (total: €154.000.000; average: €474.000 ). Reasons for this increase are big sponsor contracts of Energie direct with football club PSV and the ING Sponsorship with the Royal Dutch Football Association. Source: SponsorMonitor 2016, 2017 (Estimated spend based on input provided by advertisers. Only direct sponsor budget is included; any activation budget is excluded). | Note: The value of contracts differs from the annual sponsorship spend shown on other slides. This can be explained by contracts covering longer periods than just one calendar year.

- 33. 33 Rabobank is still by far the biggest sponsor. ING, Adidas and Ziggo showed increase in gross sponsor spend. No. Brand Gross spend 2015 Gross spend 2016 1 Rabobank € 34,000,000 € 32,000,000 2 ING € 14,000,000 € 14,500,000 3 Adidas € 13,450,000 € 14,000,000 4 ABN AMRO € 13,000,000 € 12,500,000 5 KPN € 12,700,000 € 12,500,000 6 Heineken € 11,200,000 € 11,000,000 7 Nike € 11,000,000 € 11,000,000 8 Ziggo € 9,800,000 € 11,000,000 9 VriendenLoterij € 9,600,000 € 8,500,000 10 Amstel € 8,500,000 € 7,500,000 Source: SponsorMonitor 2016 (Spend is an estimate based on input provided by advertisers. Only direct sponsor budget is included; any activation budget is excluded)

- 35. 35 Dutch consumers spend more than 3 hours per day on media* 2:29 0:14 1:01 2:01 4:10 2:26 3:08 8:28 2:25 0:12 0:52 2:07 0:57 4:18 3:36 9:29 0:00 1:12 2:24 3:36 4:48 6:00 7:12 8:24 9:36 10:48 12:00 Eating and personal care Other On the go Housework, groceries, shopping Work, study, school Leisure time Media* Sleeping Hours per day Main activities – average time spent per day Weekend Weekdays Source: Media:tijd 2015, base: all adults 13+ (N=2,953) | * media consumption not combined with any other activity

- 36. 36 Watching and listening are most time consuming media activities 2:42 3:04 0:43 1:06 0:18 0:18 0:20 Listening (online or offline) Watching (online or offline) Reading (paper or electronic) Communicating (through media) Gaming (electronic) Internet other Media other Media activities – average time spent per day Hours per day Source: Media:tijd 2015, base: all adults 13+ (N=2,953) Definitions: Listening: to radio, (own) music/audio – offline, online or apps + live or non-linear Watching: TV programs, videos or pictures - offline, online or apps + live or non-linear Reading: books, magazines, newspapers, door drops, newsletters – offline, online or apps Communicating: text messages, chat, e-mail, social media, forums, letters – offline, online or apps Gaming: consoles or game websites - offline, online or apps – except for board games and gambling Internet (other): online shopping, e-banking, search information – offline, online or apps Media (other): administration on computer, installation and use of software

- 37. 37 Overall media consumption shows stable patterns. Time spent watching shows strong peak in the evening, for listening this is higher during the day. 0 10 20 30 40 Minutes Media activities on an average day Listening (online or offline) Watching (online or offline) Reading (paper or electronic) Communicating (through media) Gaming (electronic) Internet other Media other Source: Media:tijd 2015, base: all adults 13+ (N=2,953)

- 38. 38 0% 25% 50% 75% 100% 2010 2011 2012 2013 2014 2015 2015-II2016-I Honderden TV No answer TV heavy (24+ hours per week) TV mid (14-24 hours per week) TV light (0-14 hours per week) No TV 0% 25% 50% 75% 100% 2010 2011 2012 2013 2014 2015 2015-II2016-I Honderden Radio No answer No answer Radio heavy (20+ hours per week) Radio mid (5-20 hours per week) Radio light (0-5 hours per week) No Radio Time spent online has increased over the years 0% 25% 50% 75% 100% 2010 2011 2012 2013 2014 2015 2015-II2016-I Honderden Online No answer Internet heavy (13+ hours per week) Internet mid (5-13 hours per week) Internet light (0-4 hours per week) No Internet connection Source: NPDM releases: 2010 I – 2010 II to 2015 II – 2016 I, base: All adults 13+ (N= 17.171)

- 39. 39 DEVICE OWNERSHIP AND USAGE

- 40. 40 Slightly higher smartphone penetration (83%) in 2016 39% 45% 48% 58% 65% 67% 70% 76% 80% 80% 83% 0% 20% 40% 60% 80% 100% Historical development of smartphone penetration in NL 11.1 million Smartphone users in 2016 Source: “Trends in Digital Media”, GfK Intomart, Dec 2016, base: online population 13+ (N=1,251); Global Mobile Landscape 2015, eMarketer. 13.9 million Smartphone users in 2019

- 41. 41 All age groups are becoming more mobile over the years. Significant increase of tablet usage among age group 13-17. 0% 25% 50% 75% 100% Men Women Age 13-17 Age 18-34Age 35-49 Age 50-64 Age 65+ % using a tablet 0% 25% 50% 75% 100% Men Women Age 13-34 Age 35-49 Age 50-64 Age 65+ % using a smartphone dec-12 jun-13 dec-13 jun-14 dec-14 jun-15 dec-15 dec-16 Source: “Trends in Digital Media”, GfK Intomart, Dec 2016, base: online population 13+ (N=1,150)

- 42. 42 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Averagetimespentinminutes Smartphone and tablet usage during the day Smartphone '15 Tablet '15 Smartphone '14 Tablet '14 Tablet and mobile show a similar pattern in usage during the day, with a peak in the evening. Time spent on both devices increased significantly. Source: Media:tijd 2014, base: 13+ (N=2,989) | Media:tijd 2015, base: 13+ (N=2,953)

- 43. 43 Watching TV still most popular via traditional TV set despite growing popularity of other devices. Smartphone beats laptop for using the Internet.71,3% 23,8% 28,1% 17,0% 9,1% 54,0% 10,7% 28,1% 17,0% 8,7% 74,8% 16,1% 29,0% 14,8% 14,1% 56,6% 23,0% 21,1% 12,5% 6,8% 91,5% 21,1% 3,6% 0,9% 2,6% 11,1% 2,6% 72,5% 74,9% Medium type per device Laptop PC/desktop Mobile phone Tablet Traditional TV set* Media player* Game console* Paper* Source: Media Standard Survey 2016 (N=5,100), Base: All adults 13+, (* device is not relevant for each medium type)

- 45. 45 Percentage of Dutch population owning phones and tablets is growing strongly, just like social usage. The number of Newspaper readers decreased. 0% 20% 40% 60% 80% 100% Broadcast TV viewers Mobile phone owners Internet users Radio listeners Magazine readers Smartphone owners Social network users Mobile phone internet users Tablet owners Newspaper readers Digital video viewers Cable TV viewers Media penetration in the Netherlands, 2011 - 2015 2011 2012 2013 2014 2015 Source: The global media intelligence report (November 2016) – eMarketer & SMG

- 46. 46 The Netherlands has the 9th highest internet penetration worldwide. Mainly wealthy and/or relatively small countries in top 20. 80% 90% 100% Internet access by country (top 20) in 2016 Source: http://www.internetlivestats.com/internet-users-by-country/, penetration based on total population | https://www.emerce.nl/nieuws/75plussers-sterkst-groeiende-groep-internetters In the Netherlands, Internet penetration among people older than 75 has grown substantially. In 2016, 60% of 75+ has Internet access and 50% used it. In 2012, access and usage was around 40% for this specific age group.

- 47. 47 90% 44% 25% 92% 45% 32% 93% 45% 40% 94% 46% 49% 95% 48% 55% 95% 50,70% 59,80% At home At work Elsewhere Internet access by location 2011 2012 2013 2014 2015 2016 Internet access ‘elsewhere’ (on the go) has increased substantially Source: Media Standard Survey 2011-2016 (N= 5,100), base: All adults 13+.

- 48. 48 Google is leading in terms of reach across platforms Source: GfK DAM, base: 13+, average monthly reach Q1 2017 (all platforms) No. Top 10 brands Average monthly reach 1 Google 77% 2 Facebook 67% 3 WhatsApp Messenger 63% 4 Youtube 60% 5 Facebook Messenger 51% 6 Google maps 51% 7 Google Search (app) 49% 8 Bol.com 47% 9 Digid.nl 43% 10 Marktplaats.nl 42%

- 49. 49 Main mobile activities are focused on communication in every possible way. Banking, online shopping and TV increased in usage. 83% 76% 29% 14% 22% 37% 43% 16% 70% 5%52% 67% 26% 83% 65% 27% 72% Mobile activities Internet E-mail Video TV Radio Navigation Games As e-ticket Camera Books Online banking Social media Online shopping Call Text messages Music Chat Source: “Trends in Digital Media”, GfK Intomart, Dec 2016, base: online population 13+ (N=1,065)

- 50. 50 All-round activities for tablet such as surfing the web, e-mail, social media and games. Less visual activities (photos, video) than on mobile. 29% 32% 3% 58% 13% 34% 36% 8% 15% 85% 55% 66% 13% 29% 4%16% 4% Tablet activities Video TV Text messages Social media Radio Online shopping Online banking Navigation Music Internet Games E-mail Chat Camera Call Books As e-ticket Source: “Trends in Digital Media”, GfK Intomart, Dec 2016, base: online population 13+ (N=824)

- 51. 51 Smartphone is the most used device for communication, especially among younger age groups. 7% 7% 19% 19% 48% 1% Share of all communication per device Landline/home phone Tablet Laptop PC Smartphone Other 0% 20% 40% 60% Total 13+ Men Women 13-19 20-34 35-49 50-64 65+ Share of communication per device per age group Landline/home phone Smartphone Tablet Laptop PC Source: Media:tijd 2015, base: all adults 13+ (N=2,953)

- 52. 52 0 10 20 30 40 50 Smartphone Average number of mobile apps 2011 2012 2013 2014 2015 2016 In 2016, also the number of mobile apps seems to stabilize Average # of apps on mobile in 2016: 27 Source: “Trends in Digital Media”, GfK Intomart, Dec 2016, base: online population 13+ (N=1,065) 0 10 20 30 40 50 Tablet Average number of tablet apps 2011 2012 2013 2014 2015 2016 Average # of apps on tablet in 2016: 24

- 53. 53 WhatsApp most popular mobile app. Facebook and YouTube show high reach on both devices. Netflix and Instagram are new in top 10. Source: GfK DAM, base: 13+, average monthly reach Q1 2017 25% 26% 27% 29% 38% 41% 42% 55% 50% 63% Instagram Drive Google Play-services Gmail Google Search Facebook Messenger Google Maps Youtube Facebook WhatsApp Messenger Overall top smartphone apps Phone reach % 11% 11% 11% 12% 16% 18% 20% 21% 32% 35% ING Bankieren NOS Netflix Marktplaats Gmail Google Maps Facebook Messenger Google Search YouTube Facebook Overall top tablet apps Tablet reach %

- 54. 54 WATCHING

- 55. 55 MCP: Watching The way people consume audio visual content is rapidly changing. These days the consumption of video content can be on multiple devices, in multiple places and at every moment. As a result, the way consumers experience video content is changing as well.

- 56. 56 88% Households with digital TV 1.6 Average # of TVs per household 36.8% Hard disc recorder ownership 2015 31% 37% Connected TV penetration 2015 vs. 2016 Source: Media Standard Survey 2016 Trends & developments – I

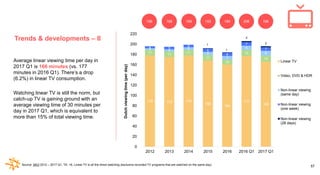

- 57. 57Source: SKO 2012 – 2017 Q1, TA: +6, Linear TV is all the direct watching (exclusive recorded TV programs that are watched on the same day) Average linear viewing time per day in 2017 Q1 is 166 minutes (vs. 177 minutes in 2016 Q1). There’s a drop (6.2%) in linear TV consumption. Watching linear TV is still the norm, but catch-up TV is gaining ground with an average viewing time of 30 minutes per day in 2017 Q1, which is equivalent to more than 15% of total viewing time. 178 175 178 168 160 177 166 11 11 11 11 10 12 12 3 4 5 6 7 8 9 4 5 5 6 6 7 7 1 1 2 2 0 20 40 60 80 100 120 140 160 180 200 220 2012 2013 2014 2015 2016 2016 Q1 2017 Q1 Dutchviewingtime(perday) Linear TV Video, DVD & HDR Non-linear viewing (same day) Non-linear viewing (one week) Non-linear viewing (28 days) 196 Trends & developments – II 196 195 199 192 184 206

- 58. 58 Trends & developments – III RTL and Triade Media extend their portfolio with three international channels: AMC, Food Network and Fine Living. AMC offers many popular movies and TV shows from all genres and has own productions. Food Network focuses on cooking shows and Fine Living offers programs about home decoration and interior design. Online publisher VICE has started a new TV-channel for millennials: VICELAND. The new TV-channel launched March 1st and is exclusively accessible for Ziggo subscribers. Benelux-CEO Thijs Boon states that VICELAND offers exclusive content with a focus on youth culture and hereby wants to become the place to reach millennials offline. Source: http://www.emerce.nl/nieuws/uitgesteld-kijken-naar-25-procent-in-2025 | http://www.adformatie.nl/nieuws/vice-komt-nederland-met-tv-kanaal-voor-millennials | http://www.adformatie.nl/achtergrond/vice- benelux-ceo-thijs-boon-viceland-moet-het-leidende-tv-kanaal-voor-jongeren-worden | | https://www.rtl.nl/adverterenbij/nieuwsberichten/rtl-en-triade-media-breiden-portfolio-uit According to research of ABN Amro, postponed TV-watching is winning popularity. It is expected that 25% of all TV content will be consumed non-linear within the next 10 years.

- 59. 59 Consumers will be exposed to more advertising on smart TV’s of Philips. After Philips updates the software consumers will see more ads in the menu’s. TP Vision, the manufacturer of Philips TV’s, has a lot of information about viewing behavior. In the near future, Philips will possibly be capable of personalized advertising. More brands (such as Samsung) are currently working on this development since watching linear TV is decreasing and people are using more apps and online services. The number of house holds with smart TV’s is still increasing but the growth seems to flatten out, reports Telecompaper. With smart TV’s people have the ability to connect to the Internet to make use of services as Netflix and YouTube and new services like Amazon Prime. Not every smart-TV is connected to Internet, but at this moment more than 50% of all house holds has at least one ‘connected’ television. https://www.emerce.nl/nieuws/aantal-huishoudens-smart-tv-stijgt-groei-neemt-af | http://nos.nl/artikel/2154753-meer-reclame-op-smart-tv-s-van-philips.html Trends & developments – IV : Smart TV

- 60. 60 Dutch TV channels, with advertising possibilities (I/II) STER (Public Broadcasting) RTL RTL/Triade SBS Source: retriever.nl, Q1 2017 | Note: As of January 2016 RTL is also responsible for the advertising on the Triade channels. Note: RTL Lounge, RTL Crime, Boomerang, Telekids and Crime + Investigation are paid (digital) channels Note: mostly paid (digital) channels

- 61. 61 Dutch TV channels, with advertising possibilities (II/II) The Walt Disney Company Benelux 57 regional channels Note: Disney XD shares a channel with Veronica Source: retriever.nl, Q1 2017

- 62. 62 Market share of NPO is increasing. In Q1 2017, SBS and BrandDeli seem to show a slight decrease in market share. 0% 10% 20% 30% 40% NPO RTL/Triade SBS BrandDeli TV market share 2014 2015 2016 2017 Q1 Source: SKO 2014 – 2017 Q1, 02.00-26.00, base: all adults 13+| Note: Full audit channels only.

- 63. 63 NPO 1 continues trend of increase in market share Source: SKO 2014 – 2017 Q1, 02.00-26.00 base: all adults 13+ | Note: Full audit channels only. STER RTL/Triade SBS BrandDeli Disney Other 0 5 10 15 20 25 30 % Market share 2014 2015 2016 2017 Q1

- 64. 64 Growth in gross media spend for all SBS channels (+11%). RTL 4 shows strongest decline. Source: Nielsen, 2016 Q1 and 2017 Q1. | Note: Only gross spend for TV. | Note: As of January 2016 RTL is also responsible for the advertising on the Triade channels. SBSRTLSTER BrandDeli RTL/Triade Disney 0 50 100 150 200 250 €millions Gross media spend per channel Q1 2016 Q1 2017 - 10%

- 65. 65 TV spend shows a clear seasonality pattern with highest spend levels in spring and fall and relatively low spend during summer. Monthly indices are used to reflect the seasonality in rate cards. Source: Nielsen, 2013 – 2017 Q1 | Note: Only gross spend for TV. 0 100 200 300 400 500 January February March April May June July August September October November December Grossmediaspend(inmillion€) TV seasonality (based on spend) 2013 2014 2015 2016 2017 Q1 Total spend 2017 Q1: € 776,092,821 Total spend 2016 Q1: € 774,534,884 Total spend 2015 Q1: € 727,121,996 Total spend 2014 Q1: € 732,229,310 Total spend 2013 Q1: € 621,144,126

- 66. 66 Retail brands (supermarkets specifically) are main TV advertisers Source: Nielsen, 2017 Q1 | Note: Only gross spend for TV. No. Brand Category TV gross spend Q1 2017 1 Jumbo supermarkten Retail €12,805,780 2 Kruidvat Retail €10,327,439 3 Albert Heijn Retail €10,140,184 4 Lidl Retail €8,817,451 5 Coop Retail €8,087,164 6 Renault Automotive €7,898,370 7 Corendon Travel €7,005,157 8 Omega Pharma FMCG €6,249,780 9 HG FMCG €6,207,113 10 Plus Retail €6,144,100

- 67. 67 The market for young females is more saturated than for young males Source: SKO, 2017 Q1, all day (02:00 – 26:00), base: all adults 13+ Female

- 68. 68 Multi-tasking on phone while watching TV is becoming more popular and consists mainly of social media, chatting, emails and games 0% 10% 20% 30% 40% 50% 60% Desktop PC e-Reader Laptop PC Mobile phone Tablet device None of the above Multi tasking while watching TV Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 0% 10% 20% 30% 40% 50% Multi tasking activities Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Source: GlobalWebIndex, 2016-2017 Q1, Base: Internet users NL16+

- 69. 69 Multitasker is mostly 16-34 years old with average to high income and rather interested in gadgets, fashion and sports 51% 49% 24% 22% 21% 21% 13% 0 50 100 150 0% 25% 50% % Index Source: GlobalWebIndex, 2017 Q1, Base: Internet Users NL16+ (N= 1300), TA: MultiTasker while watching TV (N=365) 23% 51% 26% Low (Bottom 25% income) (index 92) Mid (Mid 50% income) (index 101) High (Top 25% income) (index 107) Interests 0 50 100 150 0% 10% 20% 30% 40% 50% 60% % Agree Index Age groups Interests Income

- 71. 71 Two options for non-linear TV viewing: On TV screen (smart TV, settopbox, video or DVD recorder) Non-linear TV viewing within 6 days of programming is added to the regular TV viewing ratings. Online (laptop/tablet/mobile) VIDEO ON DEMAND Non-linear TV-viewing (broadcast by traditional broadcasters, i.e. RTL, SBS and STER) Paid professional content via non-traditional broadcasters (i.e. Netflix, Videoland) ‘Video on demand’ definition clarified Non-paid (user-generated/professional/branded) content (i.e. YouTube, Dumpert, LINDA.tv)

- 72. 72 Trends & developments- I 49% of all Dutch consumers watch paid online video content 69% of all consumers have a payed VoD subscription 14% have two subscriptions 17% have two or more 39% of all VoD subscribers have downgraded their linear TV subscription For consumers without a VoD subscription this is 15% Source: GfK Viewscape 2017, base: NL18+

- 73. 73 Trends & developments – II STER starts a trial of programmatic buying on ‘NPO Gemist’ with technology of SpotX. When watching NPO Gemist, people will be exposed to more relevant ads, matched to their own consumer profile. YouTube Red, a new, paid streaming service of YouTube will be launched in Europe in 2017. YouTube Red shows videos without advertising and has unique content, just like competitors Netflix and Amazon. It is not yet confirmed that/when YouTube Red will be launched in the Benelux. Netflix grew in 2016 to 94 million subscribers and to 2,4 billion dollar revenue worldwide. The biggest growth originates from outside the US. In the Netherlands, Netflix reaches more than 28% of all house holds. However, 41% quit Netflix after the free trial. Source: http:// http://www.emerce.nl/nieuws/ster-tekent-spotx-programmatic-videocampagnes | http://www.emerce.nl/nieuws/youtube-red-europa | https://www.emerce.nl/nieuws/resultate-netflix-beter-dan- verwacht I https://tweakers.net/nieuws/118993/amazon-maakt-prime-video-dienst-beschikbaar-in-nederland-en-belgie.html Amazon launched its new video streaming service: Amazon Prime. From December 2016 on, the service is available in the Netherlands. Amazon offers movies and TV-shows, including exclusive content. A subscription costs 6 euro p/month, the first half year 3 euro p/month.

- 74. 74 Trends & Developments - III : Streaming services with opportunity to watch content offline Videoland is planning to offer content offline. At the end of 2016 it is already possible to watch children’s programs offline. In 2017 more content will be available to watch without an Internet connection. Videoland is a streaming service of RTL and offers national and international movies and TV shows. Netflix seems to be following the trend of music streaming services to let subscribers consume content offline. Currently it is only possible to watch Netflix- original content offline. Netflix is dependent on responsible film companies in order to offer more content in the offline version. Source: http://www.emerce.nl/nieuws/videoland-maakt-offline-kijken-kinderfilms-series-mogelijk | http://www.metronieuws.nl/xl/digitaal/2016/06/netflix-test-met-nieuwe-offline-modus

- 75. 75 Main players VoD – non-linear TV viewing Hard disk recorder ‘RTL XL’ & ‘Kijk’ A selection of TV content from the RTL/SBS channels. It also includes previews of shows and a selection of movies and series (mostly paid content). RTL offers content on subscription base; ‘RTL XL Premium’ (€4.- per month). Available via laptop, smartphone, tablet and smart TV. ‘NPO Plus’ (NPO) TV content from all the public TV channels. Free and available via laptop, smartphone, tablet and smart TV. NLziet (NPO, RTL, SBS) NLziet is a subscription (€8.- per month) for the three online platforms NPO Plus, RTLXL and Kijk. Subscribers can watch all content of Dutch TV up until 365 days after broadcasting. No advertising. Available via laptop, smartphone and tablet. ‘KNIPPR’ KNIPPR offers a fixed, online TV subscription with options to extend with additional channels for €11 per month.

- 76. 76 Main players VoD – non-traditional Cinema media owner Pathé developed a platform to watch movies at home (pay-per-movie). Available via laptop, tablet, smartphone and smart TV. Netflix entered the Dutch market in September 2013. For €8.- per month users have a basic account and have unlimited access to movies and series. Next to the basic subscription Netflix also offers a standard (€10.-) and premium (€12.-) subscription. Available via laptop, tablet, smartphone and smart TV. YouTube offers mostly user-generated content. The first paid channels have already been introduced. Available via laptop, tablet, smartphone and smart TV. Videoland was once the biggest offline movie rental company in the Netherlands. They now offer a lot of on-demand movies (pay-per-movie). Available via laptop, tablet, smartphone and smart TV. In August 2013 RTL took over Videoland. Ziggo introduced the Movies & Series XL service in 2017. Combined with a TV subscription (including 55 TV channels) it is possible to watch all HBO produced content from the last years on demand for €7.- per month on TV, laptop, tablet and smartphone. OTHER

- 77. 77 YouTube is leading VoD channel followed by Netflix. Both NPO and KIJK show annual growth. Source: GfK DAM, base: 13+, average monthly reach 2016 – 2017 Q1 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Jan '16 Feb '16 Mar '16 Apr '16 Mei '16 Jun '16 Jul '16 Aug '16 Sep '16 Oct '16 Nov '16 Dec '16 Jan '17 Feb '17 Mar '17 Video on Demand – average monthly reach YouTube RTL XL Netflix NPO gemist Vimeo KIJK.nl NLziet

- 78. 78 Netflix is especially popular among younger age groups. For SBS, it is more difficult to reach youngsters (13-19). 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% Total 13+ 13-19 years 20-34 years 35-49 years 50-64 years 65 + Monthly reach Netflix RTL XL NPO gemist KIJK.nl Source: DAM 13+, Jan 2017 – Mar 2017 (average monthly reach) | SKO 13+, Jan 2017 – Mar 2017, all day, average monthly reach within period STER: 97% RTL: 96% SBS: 95% STER: 94% RTL: 93% SBS: 92% STER: 98% RTL: 98% SBS: 97% STER: 99% RTL: 99% SBS: 98% STER: 96% RTL: 96% SBS: 95% STER: 93% RTL: 93% SBS: 88%

- 79. 79 Watching TV on smartphone is gaining popularity Source: GfK Trends in Digitale Media, Dec 2016 (N=1.251) | Source: GWI on-demand media service Q4 2015 – Q1 2017, base: NL 20-49 28% 30% 11% 18% 26% 31% 8% 24%24% 32% 12% 26% 25% 31% 14% 27% 23% 31% 15% 26% 24% 29% 15% 26% 21% 28% 17% 25% 0% 5% 10% 15% 20% 25% 30% 35% Desktop (PC) Laptop/Netbook Smartphone Tablet Devices used by people to watch television Jun 13 Dec 13 Jun 14 Dec 14 Jun 15 Dec 15 Dec 16 21,0% 11,9% 3,4% 27,2% 15,1% 5,6% 31% 11% 4% 35,2% 14,1% 2,9% 38,2% 17,2% 5,6% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% Netflix RTL XL Videoland Which of the following content services have you used in the last month? 2016 Q1 2016 Q2 2016 Q3 2016 Q4 2017 Q1

- 80. 80 0 50 100 150 200 250 18-34 year 35-54 year 55+ year Minutesperday Online video consumption 3.40 hours 1.30 hours 0.40 hours Big differences in time spend watching online video between age groups. Millennials watch more than 3 hours per day. Source: GfK Viewscape 2017, base: NL18+

- 81. 81 NPO programs and TV series are popular for catch up TV Date Day Program top 10 Channel GRP’s 1 25-02-2017 Sat Wie is de mol NPO 1 779 2 03-02-2017 Fri Flikken Maastricht NPO 1 525 3 26-02-2017 Sun Boer zoekt vrouw internationaal NPO 1 471 4 20-01-2017 Fri Ik vertrek NPO 1 444 5 26-02-2017 Sun Floortje naar het einde van de wereld NPO 1 420 6 22-01-2017 Sun Zondag met lubach NPO 3 418 7 16-03-2017 Tue Klem NPO 1 379 8 25-02-2017 Sat Moltalk NPO 1 333 9 20-02-2017 Ma Geheime leven van 4 jarigen NPO 1 294 10 06-03-2017 Ma Celblok H SBS 6 281 Source: SKO, best watched catch-up tv shows via television,+ 02:00-26:00 UUR, 6+, 2017 Q1

- 82. 82 Cooking, sports, traveling and special interests are most popular topics for online video content 31% 6% 8% 8% 11% 11% 15% 18% 19% 23% 26% 29% 33% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% None Other Banking (Raising) kids Energy Health Beauty Electronics Cultivate Traveling Sports Hobby Cooking Topics watched – Online video % watched in the last year Source: Online Video Monitor 2017 – SAMR Smartagent Marketingresponse, Base: NL 18-54 69% of Dutch population (18-54) watch online videos

- 83. 83 Kwebbelkop, the vlogger with most subscribers, has more than 2 billion views in total Rank User Total Video Views Subscribers Category 1 Kwebbelkop 2,087,994,143 2,830,014 Vlogs 2 EnzoKnol 1,081,890,272 1,454,240 Vlogs 3 Heroes TEAM 628,801,562 982,054 Vlogs 4 NikkieTutorials 463,865,622 6,385,539 Vlogs 5 StukTV 372,415,886 1,351,738 Vlogs Source: Socialblade, Top 10 YouTubers in The Netherlands by most viewed | 09/02/2017

- 84. 84 CINEMA

- 85. 85 34.1 million cinema visitors in 2016 (+3.7%) €8.42Average price per ticket (+0.5%) €287.1million in ticket revenue in 2016 Trends & developments – I Source: https://foxscreen.nl/2017/01/11/bioscoopbezoek-groeit-naar-ruim-34-miljoen/ | http://www.marketingtribune.nl/media/nieuws/2016/09/nederlandse-bioscopen-koersen-op-recordjaar-van- 293-miljoen-euro-omzet/index.xm | From 2015 to 2016 the number of cinema visitors went up by 3.7%. The total number of cinema visitors is at a historically high level (only seen in 1967 and 2015).

- 86. 86 Trends & developments – II The positive cinema developments of 2016 seem to continue in 2017 Q1. In the first months of this year, the number of visitors increased with 18% compared to the same period in 2016. Movies Sing, Fifty Shades Darker and Beauty and the Beast were the most popular titles. After the opening of Kinepolis Jaarbeurs cinema in Utrecht with 14 halls and 3.200 seats, Jean Mineur Mediavision will further extend the network in July with 15 new VUE cinema’s. Jean Mineur hereby strengthened its position as market leader. Source: http://www.marketingtribune.nl/media/nieuws/2017/05/uitbreiding-bioscoopnetwerk-jean-mineur-mediavision/index.xml

- 87. 87 In 2016, he movie ‘Bridget Jones’s Baby’ was the most popular film Title Revenue (in ‘000) Visits (in ‘000) Bridget Jones’s Baby € 10,300 1,191 Finding Dory € 8,900 1,082 Huisdiergeheimen € 8,100 1,024 The Jungle Book €9,446 967 Fantastic Beasts €8,658 874 Source: Nederlandse Vereniging van Filmdistributeurs (Dutch Film Distributors Association) and Nederlandse Vereniging van Bioscoopexploitanten (Dutch Association of Cinema Media Owners), annual report 2016

- 88. 88 #locations #cinema halls #seats #visitors Q1 Pathé(incl. CineMec) 25 202 42,136 4,435,828 Kinepolis 15 103 20,198 858,745 VUE 6 41 8,306 547,625 Other 29 131 20,060 1,442,752 Total 75 (54%) 477 (65%) 90,700 (70%) 7,284,950 (78%) #locations #cinema halls #seats #visitors Q1 VUE 15 71 12,845 612,912 RSB Cinemas 6 20 2,329 220,032 Other 43 164 23,560 1,224,019 Total 64 (46%) 255 (35%) 38,734 (30%) 2,056,963 (22%) Source: Jean Mineur & Fox Screen, Q1 2017 FoxScreen entered the market in 2015 but with a market share of 78%, Jean Mineur remains dominant.

- 89. 89 Number of cinema visitors increased in line with the number of film releases - 100 200 300 400 500 0 5 10 15 20 25 30 35 40 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 #Cinemas&FilmReleases Visitorsinmillion # Visitors (million) # Film releases # Cinemas Source: Nederlandse Vereniging van Filmdistributeurs (Dutch Film Distributors Association) and Nederlandse Vereniging van Bioscoopexploitanten (Dutch Association of Cinema Media Owners), annual report 2016

- 90. 90 Increase of cinema visits mainly because of relatively high number of visits in August, September and October. 0 500 1.000 1.500 2.000 2.500 3.000 3.500 4.000 4.500 Visitsin‘000 Cinema visits per 4 weeks 2016 2015 2014 Source: Nederlandse Vereniging van Filmdistributeurs (Dutch Film Distributors Association) and Nederlandse Vereniging van Bioscoopexploitanten (Dutch Association of Cinema Media Owners), annual report 2016

- 91. 91 For cinema there is a clear increase in gross media spend towards the end of the year. Cinema vendors use monthly indices to reflect seasonality patterns in their rate cards. Source: Nielsen, 2014 – 2017 Q1 | Only gross spend for cinema 0,0 0,5 1,0 1,5 2,0 2,5 3,0 3,5 4,0 4,5 5,0 January February March April May June July August September October November December GrossMediaspend(in€millions) Seasonality cinema 2013 2014 2015 2016 2017 Q1 Total spend 2017 Q1: 3,366,699 Total spend 2016 Q1: 4,212,792 Total spend 2015 Q1: 3,307,903 Total spend 2014 Q1: 2,904,074 Total spend 2013 Q1: 3,653,400

- 92. 92 Regular cinema visitors are younger than average. High social class for both regular as non-regular and 50/50 on gender. 50% 50% Profile regular cinema visitor Source: NOM Print & Doelgroep Monitor 2015 II – 2016 I, base: total NL 13+ (N= 17.171) | * Regular cinema visitor is defined as someone who visits a cinema at least once a month, non-regular visitors are people who visit the cinema less than once a month, excluding people who never visit the cinema. Profile non-regular cinema visitor 3% 30% 19% 21% 17% 11% 13-14 (index 105) 15-24 (index 201) 25-34 (index (131) 35-49 (index 83) 50-64 (index 71) 65+ (index 57) Social class % Index A 33% 150 B1 26% 112 B2 22% 107 C 9% 62 D 10% 51 Social class % Index A 27% 125 B1 26% 114 B2 23% 112 C 13% 84 D 11% 56 48% 52% 4% 20% 17% 31% 19% 9% 13-14 (index 154) 15-24 (index 138) 25-34 (index (122) 35-49 (index 123) 50-64 (index 79) 65+ (index 45)

- 93. 93 In 2016, cinema reach among age group 16-39 increased significantly 75% 83% 73% 61% 59% 62% 43% 32% 76% 72% 89% 84% 70% 60% 42% 31% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 6-11 12-15 16-23 24-29 30-39 40-54 55-64 65+ Cinema reach 2015 2016 Source: Bioscoopmonitor 2016, Stichting Filmonderzoek

- 94. 94 LISTENING

- 95. 95 MCP: Listening Consumers´ listening patterns are constantly changing. Players such as Spotify have entered the market and are changing the way consumers experience music. The availability of music and radio via multiple devices further impacts how people experience listening to music.

- 96. 96 Trends & developments - I The Media Exchange and OMS are ending their co- operation after a very successful year (turnover and number of advertisers). With a growing online radio industry, both publishers expect to serve the market better apart from each other. Soundcloud has launched paid subscriptions ‘Go-’ and ‘Go+’, in the Netherlands. ‘Go-’ will cost €6,- per month and ‘Go+’ €10,- per month based on the size of the music offer. For both subscriptions users are not exposed to advertising and are able to listen music offline. STER starts with advertising sale for radio channel FunX. FunX is the urban channel for young people. STER sees this partnership as a complement to its own, current channel, NPO 3FM. Source: https://www.emerce.nl/nieuws/omzet-online-radioreclame-verdubbelde-2016 |http://onemediasales.cmail19.com/t/| https://www.emerce.nl/nieuws/betaalde-abonnementen-soundcloud-nederland | http://www.adformatie.nl/nieuws/ster-doet-landelijke-reclameverkoop-npo-funx | https://www.radiofreak.nl/rtl-nederland-helemaal-gestopt-met-radio/ RTL fully stopped with radio, after it said farewell to digital radio channel RTL Lounge Radio. Talpa Radio has replaced the FM channel with ‘Sky Radio Smooth Hits’. Previously, RTL owned radio channels Yorin FM, RTL FM and partially Radio 538.

- 97. 97 Trends & developments - II The current broadcasting licenses of commercial radio for broadcasting via FM, AM and DAB+ originally expired in 2017, but are extended until 2022. The government will assign new licenses by auction, an idea that caused a lot of resistance. By the extension, minister Kamp meets the needs of radio stations and the Dutch House of Representatives. Radio stations who want to broadcast on FM, also have to broadcast through DAB+. Since 2015 also DAB+ licenses without FM are sold by the government. The Media Exchange supports real time buying of radio spots the same way online display advertisements are bought. The independent platform offers real-time programmatic buying at theme stations (e.g. 538 dance department, Sky radio lounge, etc). MobPro and Spotify created a technical link to give advertisers the possibility to programmatically buy advertising space within the Spotify app. Advertisers are able to target on preferences of listeners and can buy both display banners and audio spots. Source: http://www.themediaexchange.nl/?mc_cid=b905d536f1&mc_eid=5ced93674c I http://www.emerce.nl/nieuws/mobpro-koppelt-spotify-audioreclame

- 98. 98 Dutch radio stations, with advertising possibilities (I/II) STER One Media Sales Q-Music NL TMG Source: retriever.nl, Q1 2017

- 99. 99 Dutch radio stations, with advertising possibilities (II/II) E-power advertising* FD Mediagroep ORN* 22 online stations Source: retriever.nl, Q1 2017 * ORN (government) and E-Power are responsible for approximately 30 regional stations

- 100. 100 Market share of NPO 3FM is further decreasing, NPO Radio 2 shows growth. Q1 2017 was particularly successful for Sky Radio, Q-music and Radio 538. Source: NLO, 2016 May-Jun - 2017 Mar-Apr. Base: NL 10+ 0% 5% 10% 15% Market share (%) May-Jun 2016 Jul-Aug 2016 Sep-Oct 2016 Nov-Dec 2016 Jan-Feb 2017 Mar-Apr 2017

- 101. 101 Increase of spend for NPO Radio 2 and Q-music. Decrease for NPO 3 FM and for BNR Nieuwsradio. 0 5 10 15 20 25 30 35 40 45 MediaSpendperStation(inMillions) Gross Media Spend 2016 Q1 2017 Q1 +7% -26% +339% -40% +25% Source: Nielsen, 2016 Q1 – 2017 Q1. Gross spend for radio only.

- 102. 102 0 10.000 20.000 30.000 40.000 50.000 60.000 70.000 80.000 90.000 100.000 January February March April May June July August September October November December X1000 Gross media spend Radio 2013 2014 2015 2016 2017 Q1 Seasonality of radio shows low spend in Summer period and high peak in Q4 (Christmas and top lists at the end of the year). Some Radio vendors use monthly indices to reflect the seasonality influences in their rate card. Source: Nielsen, 2014 – 2017 Q1. Gross spend for radio only. Total spend 2017 Q1: € 181,989,537 Total spend 2016 Q1: € 182,788,075 Total spend 2015 Q1: € 178,544,011 Total spend 2014 Q1: € 151,617,468 Total spend 2013 Q1: € 143,566,478

- 103. 103 The automotive category is well represented within top 10 radio advertisers Brand Category Gross radio spend Q1 2017 1 Kruidvat Retail €4,704,014 2 Renault Automotive €4,651,772 3 Mercedes Benz Automotive €3,737,800 4 Volkswagen Automotive €3,495,220 5 ZIGGO Internet €3,289,352 6 Fiat Automotive €2,918,192 7 LIDL Retail €2,634,921 8 Vodafone Telecom €2,583,653 9 Aldi Retail €2,581,976 10 KPN Telecom €2,539,394 Source: Nielsen, Q1 2017. Gross spend for radio only.

- 104. 104 Some clutter in channels aimed at older audiences. A young and more female station is missing in the radio landscape. Source: NLO, 2017 (Mar-Apr), TA: NL 10+ Young Female Radio Veronica ‘Oldies’ (music more than 5 years old) BNR Nieuws Radio News SLAM! Dance and new hits Sublime FM Jazz, soul, latin and lounge 100% NL Dutch Male Old

- 105. 105 Streaming music Application-based music streaming service with 6,8 million users. Free and paid subscription options; 40% of the Dutch users are paying for the streaming service. Average monthly reach Q1 2017: 24,7% Audio platform that originally enables sound creators to share their created sounds. Streaming music available for free or through paid subscription. Average monthly reach Q1 2017: 4,1% Music streaming service for web and app. Spot advertising within playlist possible. Free and paid subscription options. Average monthly reach Q1 2017: 1,2% Music application of Apple for streaming music and an extension of iTunes. Only available through paid subscription. Average monthly reach Q1 2017: 19% Source: Spotify | DAM Q1 2017 (TA 13+ N=1,091), Average monthly reach all platforms | Ownership Spotify - Trends in Digital Media, GfK Intomart, Dec 2014, base: online population 13+ who own a tablet and/or smartphone AND have al least one app

- 106. 106 TV is the most popular device for listening to radio. Strong increase for listening radio through smartphone. 0% 5% 10% 15% 20% 25% 30% 35% 40% June '12 Dec '12 June '13 Dec '13 June '13 Dec '14 Juni '15 Dec'15 Dec'16 %Agreetolistenviadevice Digital radio listening* Desktop Laptop Smartphone Tablet Television** Streaming- network audioplayer Source: Trends in Digital Media 2016, GfK Intomart, December 2015, base: online population 13+ (N=1,151) *Claims to listen radio via device **Television was previously reported as SettopBox. Since the December 2015 publication it’s categorized under television.

- 107. 107 Most time spent on online radio via TV. Radio station apps are becoming more popular, although Spotify remains dominant. 45 107 21 60 36 11 0 50 100 150 200 250 300 Average minutes per week Desktop TV Laptop Streaming-/network player Smartphone Tablet 0% 5% 10% 15% 20% 25% Spotify Radio 538 NPO 3FM Q-music Nederland.fm NPO radio 2 NPO radio 1 Sky Radio 100%NL Radio Veronica Radio 10 Radio Apps (downloaded) Tablet (n=808) Smartphone (n=1056) Source: Trends in Digital Media, GfK Intomart, December 2016, base: All (n=1.151) Source: Trends in Digital Media, GfK Intomart, December 2016, base: owners of tablet and/or smartphone

- 108. 108 READING

- 109. 109 MCP: Reading Reading is slowly shifting from paper to (online) screens. More and more people are reading newspapers on their tablet or mobile phone. Increasingly, news content is being accessed via free news sites or apps. These new possibilities to get news and read magazines are changing the experience of reading.

- 110. 110 Trends & Developments – I : pay-per-article/micropayments Blendle (alternatives: Maggy, Elinea) is a micropayment platform for quality content. Subscribers can top up their Blendle wallet and are then only one click away from buying articles from various newspapers and magazines. After steadily expanding in its Dutch home market since its launch in 2014, the platform has also been launched in Germany (2015) and is in a beta trial phase in the US (2016). As part of its international expansion plan, Blendle has expanded its portfolio by adding international newspaper titles such as The New York Times, The Wall Street Journal and The Washington Post, as well as Times Inc magazines, amongst others. In 2016, Blendle acquired the similar digital reading app ‘Paper’ of De Persgroep.

- 111. 111 Trends & developments - II Research from PWC shows that ‘print’ consumption will further decrease because consumers are shifting more to online media. PWC calculated a revenue drop of 3.3% for magazines and 1.9% for newspapers within 5 years. Source: http://www.emerce.nl/nieuws/blendle-test-premiumdienst-vast-bedrag-per-maand | http://www.bladendokter.nl/pwc-uitgevers-blijven-komende-5-jaar-moeilijk-houden/ | http://www.emerce.nl/nieuws/nrc- stapt-uit-blendle-na-introductie-premium-abonnement | https://www.emerce.nl/nieuws/fd-heeft-grootste-betaalde-digitale-oplage Online kiosk Blende starts a new monthly subscription service ‘Blendle Premium’. For €10.- per month, users don’t need to pay per article anymore, which was the only payment possibility. Also, Blende does not offer all articles but makes a selection based on user profiles. NRC decided to quit its partnership with Blendle. Chief Editor Vandermeersch argues that Blendle is not contributing to high quality journalism because of the ‘cheap’ premium option and the lack of interactive possibilities (such as video). Of all national newspapers, ‘Financieel Dagblad’ has relatively the largest digital circulation. 60% of the total circulation is digital, compared to an average of 30%. With 68,646 digital subscribers, FD follows Telegraaf (232,039) and Volkskrant (88,535).

- 112. 112 Trends & developments - III Source: http://www.adformatie.nl/nieuws/nrc-handelsblad-en-nrcnext-vanaf-volgend-jaar-een-krant | http://www.bladendokter.nl/het-verschil-tussen-chantal-linda-en-wendy/ | https://www.emerce.nl/nieuws/papieren-editie-hitkrant-stopt NRC combined it’s newspapers ‘Handelsblad’ and ‘Next’. All readers will receive the same newspaper. NRC Next stays a morning newspaper and NRC Handelsblad an afternoon version. After 40 years, ‘Hitkrant’ stops with its paper version and shifts focus to the online platform and social media. On March 28th the magazine launched for the very last time with a special extended edition. From now on, a paper version will be published only six times per year with extra posters and images. Chantal Janzen launches a new glossy ‘&C’ focused on fashion, beauty, food and lifestyle. Chantal follows colleagues ‘Linda de Mol’ and ‘Wendy van Dijk’ who are all TV personalities with a magazine. The circulation of &C will be 100,000 per month and next to a paper edition there will be an app, website and online shop.

- 113. 113 Newspapers print circulation is dominated by national newspapers 1.427 1.138 377 - 200 400 600 800 1.000 1.200 1.400 1.600 2016 Q2 - 2017 Q1 €x1000 Moving year average circulation figures (in ‘000s) National newspapers Regional newspapers Free sheets Source: NOM, 2016 Q2 – 2017 Q1 | moving year average circulation figures. Based on print only (all paid-for and free-of-charge circulation)

- 114. 114 Top 10 ranking Title Newspaper type Total annual paid circulation 2016 Q2 – 2017 Q1 Total annual circulation 2016 Q2 – 2017 Q1 1 De Telegraaf National 373351 415306 2 Metro Free sheets 0 376728 3 AD National 311723 360799 4 de Volkskrant National 215409 258783 5 NRC Handelsblad National 134191 143821 6 De Limburger Regional 122189 127113 7 De Gelderlander Regional 104359 115049 8 Trouw National 87819 104530 9 De Stentor Regional 89593 99036 10 Dagblad van het Noorden Regional 92851 98418 De Telegraaf is leading in terms of print circulation. Source: NOM, 2016 Q2 – 2017 Q1 annual moving average circulation figures for newspapers. Based on print only (all paid-for and free-of-charge circulation), excluding digital circulation figures.

- 115. 115 National papers AD and Telegraaf are leading in terms of reach. Ranking National newspapers in terms of audience reach Average issue reach amongst NL 13+ (in ‘000s) Average issue reach amongst NL13+ (%) 1 AD Dagbladen 1.317,5 9,2 2 De Telegraaf 1.296,5 9,0 3 Metro 1.080,3 7,5 4 de Volkskrant 749,2 5,2 5 NRC Handelsblad 355,2 2,5 6 Trouw 337,1 2,4 7 Reformatorisch Dagblad 170,4 1,2 8 NRC.next 128,6 0,9 9 Het Financieele Dagblad 124,6 0,9 Source: NOM Print Monitor 2017-I, base: total NL 13+ (N=17,179)

- 116. 116 Higher online reach for news site Nu.nl than digital replica of traditional print titles. Nevertheless, more visits and higher visit frequency for NOS. No. Top 10 online News brands Reach (%) Reach (‘000) # Visits (‘000) Avg visit frequency 1 NU.nl 48,6 6.920.000 151.479 21,9 2 NOS 48,5 6.915.000 232.472 33,6 3 AD 39,3 5.605.000 96.841 17,3 4 Telegraaf 36,8 5.236.000 139.489 26,6 5 RPO 34,6 4.933.000 90.301 18,3 6 RTL Nieuws 24,9 3.546.000 30.283 8,5 7 De Volkskrant 17,7 2.520.000 23.581 9,4 8 Prive 12,3 1.757.000 10.241 5,8 9 NRC 10,7 1.518.000 10.217 6,7 10 Omroep brabant 9,3 1.327.000 17.046 12,8 Source: DAM, base: 13+, average reach Q1 2017 all platforms

- 117. 117 0 20 40 60 80 100 120 140 January February March April May June July August September October November December Grossspendnewspapers(inMillions) Seasonality newspapers 2013 2014 2015 2016 2017 Q1 Lower ad spend in dailies in Summer. 2017 Q1 spend levels are higher than 2016 Q1, but still lower than previous years. Source: Nielsen, 2013 -2017 Q1. Gross spend for newspaper advertising only. Total spend 2017 Q1: € 220,349,390 Total spend 2016 Q1: € 178,879,156 Total spend 2015 Q1: € 275,585,434 Total spend 2014 Q1: € 255,306,640 Total spend 2013 Q1: € 292,194,772

- 118. 118 No. Brand Category Newspapers gross spend Q1 2017 1 Corendon Travel €8,510,062 2 Kras reizen Travel €7,659,468 3 Stip reizen Travel €7,365,124 4 Koopjedeal.nl Travel €5,127,126 5 Bolderman Travel €4,724,796 6 Zadkine media Media €3,642,475 7 Effeweg.nl Travel €3,438,069 8 NRC Media €2,976,658 9 Stella Transport €2,942,864 10 NRC Live Media €2,717,400 Travel brands are dominating the top 10 advertisers in newspapers Source: Nielsen, 2017 Q1 | Gross spend for newspapers only.

- 119. 119 High increase of spend for AD Nieuwsmedia and De Volkskrant compared to 2016 Q1. Spend for Telegraaf decreased. 0 5 10 15 20 25 30 35 Mediaspend(inmillions) Gross media spend Newspapers 2016 Q1 2017 Q1 +88% -24% Source: Nielsen, 2016 Q1 – 2017 Q1. Gross spend for newspapers only. +87%

- 120. 120 The growth of digital use of newspapers seems to have stagnated over the last year across all devices. 38% 20% 20% 36% 21% 23% 35% 22% 24% 39% 27% 28% 36% 27% 27% Pc/Laptop Mobile Tablet NPDM 2013 I - 2013 II NPDM 2013 II - 2014 I NPDM 2014 I - 2014 II NPDM 2015 I - 2015 II NPDM 2015 II - 2016 I Source: NPDM releases: 2013 I – 2016 I, base: total NL 13+ Digital use of newspapers

- 121. 121 Family, culinary and women’s titles show highest circulation figures, with increase for culinary and travel. 0 500 1000 1500 2000 2500 3000 3500 4000 4500 Family Culinary mags (incl sponsored) Women's TV listings Newspaper magazines Home decoration, gardening & DIY Special interest Mind & body Travel Popular Science Youth Education Moving year average total circulation (in ‘000s) Q1 2016 - Q4 2016 Source: NOM, 2016 Q2 – 2017 Q1 annual moving average circulation figures. Based on total magazines (all paid-for and free-of-charge circulation).

- 122. 122 High circulation numbers for sponsored magazines. Kampioen has by far the highest total circulation. Top 10 Title Magazine type Total paid circulation 2016 Q2 – 2017 Q1 Total circulation 2016 Q2 – 2017 Q1 1 Kampioen Family 3409112 3409112 2 Allerhande Culinary sponsored 0 2019907 3 Boodschappen Culinary sponsored 0 1901586 4 Eigen Huis magazine Home decoration, gardening & DIY 751803 751803 5 Vrouw Women’s 0 510743 6 Vrij Newspaper mags 0 507136 7 Burgerkracht Special Interest 0 496119 8 AD Magazine Newspaper mags 0 411997 9 Het Volkskrant Magazine Newspaper mags 0 370736 10 Libelle Women’s 292255 297778 Source: NOM, 2016 Q2 – 2017 Q1 annual moving average print circulation figures for magazines

- 123. 123 Source: NOM Print Monitor 2017-I, base: total NL 13+ (N=17,179) Women’s and family titles have highest reach Top 10 magazine titles in terms of audience reach Publication type Average issue reach amongst NL 13+ (in ‘000s) Average issue reach amongst NL13+ (%) Kampioen Family 4.852,1 33,8 Allerhande Culinary sponsored 4.239,6 29,6 Libelle Women’s 1.622,1 11,3 Donald Duck Kids 1.396,3 9,7 LINDA. Women’s 1.192,7 8,3 Vrouw Women’s 1.137,0 7,9 Privé Celebrity 1.041,2 7,3 Margriet Women’s 1.036,1 7,2 Veronica Magazine Television magazine 984,9 6,9 Quest Science 975,4 6,8

- 124. 124 0 10 20 30 40 50 60 January February March April May June July August September Oktober November December Magazines grossmediaspendinmillions Seasonality Magazines 2013 2014 2015 2016 2017 Q1 Ad spend in magazines peak in Spring, early Summer and during the holiday season (December). Source: Nielsen, 2013 – 2017 Q1. Gross spend for consumer magazines only. Total spend 2017 Q1: € 83,860,128 Total spend 2016 Q1: € 82,193,705 Total spend 2015 Q1: € 86,926,763 Total spend 2014 Q1: € 98,803,815 Total spend 2013 Q1: € 113,873,869

- 125. 125 No. Brand Category Gross spend in Q1 2017 1 Sanoma Media € 1,148,783 2 Hollands Nieuwe Telecom € 1,147,852 3 Corendon Travel € 1,140,911 4 Unox FMCG € 1,071,013 5 ANWB Travel € 1,055,265 6 Elsevier Media € 999,144 7 Cookloveshare.nl Media € 958,999 8 Albert Heijn Retail € 824,350 9 Otolift Home € 768,392 10 Voordeeluitjes.nl Travel € 754,112 When looking at individual brand level, Sanoma and Hollands Nieuwe are main print advertisers. Source: Nielsen, 2017 Q1. Gross spend for consumer magazines only.

- 126. 126 Libelle shows high increase of spend levels and is now leading in stead of Allerhande. Woman titles show overall increase of spend. 0 1 2 3 4 5 6 7 8 9 Mediaspend(inmillions) Gross media spend magazines 2016 Q1 2017 Q1-21% +54% Source: Nielsen, 2016 Q1 – 2017 Q1. Gross spend for consumer magazines only.

- 127. 127 High consumption of door drops mainly by older generations. 91% 86% 82% 78% 73% 64% 62% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total Reach % 25% 15% 27% 33% 41% 47% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 13-14 15-24 25-34 35-49 50-64 65+ Total Reach % High consumption of door drops (> 13.5 titles)Reach per category Source: NOM folder monitor 2017 *Media imperatives are based on frequency of appearance

- 128. 128 Albert Heijn door drops have highest reach, both print as digital No. Brand Category REACH PRINT (IN %) REACH DIGITAL (IN %) 1 Albert Heijn Supermarket 55.9% 12.4% 2 Kruidvat Drugstore 54.1% 9.7% 3 Lidl Supermarket 45.8% 9.1% 4 Blokker Household 44.7% 5.9% 5 Aldi Supermarket 44.4% 6.6% 6 Hema Household 41.4% 6.5% 7 Mediamarkt Electronic 37.3% 6.2% 8 Gamma House / Garden 37.0% 4.4% 9 Praxis House / Garden 35.4% 4.1% 10 Karwei House / Garden 32.5% 3.3% Source: NOM Folder Monitor 2017

- 129. 129 COMMUNICATING

- 130. 130 MCP: Communicating Human beings are a social species, with communication taking place throughout the day. Face-to-face interaction won´t disappear anytime yet but the younger generations don’t differentiate so much anymore between online/offline communications. The social experience around communication is changing as communicating via Facebook Messenger, WhatsApp, Snapchat and the like is getting more and more accepted.

- 132. 132 Trends & developments – I Facebook extends the video possibilities for advertisers by offering the ‘mid-roll’ format. From now on, video content can be interrupted with commercials. The same applies to live video. Source: http://fonkonline.nl/artikelen/tech/amerikaanse-verkiezingen-schudden-google-en-facebook-wakker-38544.html | https://www.emerce.nl/nieuws/instagram-stories-krijgt-full-screen-reclame | https://www.emerce.nl/nieuws/facebook-alle-remmen-los-video-advertenties Google and Facebook will try to avoid (or delete) advertisements on pages with fake news. This was a reaction after the American elections. It appeared that Facebook and Google were determining for the outcome of the US elections. Instagram Stories will offer full screen advertising options within the new Story feature of full screen content that disappears after 24 hours. Brands also have the opportunity to use the ‘Stories’ feature in the same way as consumers (this only can be seen by users who follow the brand).

- 133. 133 Trends & developments – II Source: https://www.iculture.nl/nieuws/whatsapp-status-snapchat/ | https://www.emerce.nl/nieuws/snapchat-ontbreekt-meeste-nederlandse-mediaplannen | https://www.emerce.nl/nieuws/groei- snapchat-nederland-neemt-laatste-maanden-snel-af | https://www.emerce.nl/nieuws/twitter-jaarcijfers After Snapchat, Instagram and Facebook Messenger, people can now also share their ‘live’ or daily content on WhatsApp with ‘WhatsApp status’. Just as for the other platforms users are able to share their story with contacts for 24 hours, after that it will be removed automatically. In Q4 2016, the turnover of Twitter was 717 million dollars in stead of the expected 740 million dollars. The net loss was 167 million dollars, twice as much as in 2015. The number of monthly, active users of Twitter is not growing. As a result of disappointing developments the Dutch offices closed before. BrandDeli is now responsible for sales of Twitter. Based on research of MeMo2, Snapchat is not yet included in many media plans since it is hard to justify budgets while the results are hard to measure/compare with other media types. Nevertheless is 54% of users between 12 and 24 using it daily and 70% using it monthly. Telecompaper reveals that the growth of Snapchat stagnated, in terms of followers and usage. The photo app seems to be especially popular among teenagers and young millennials.

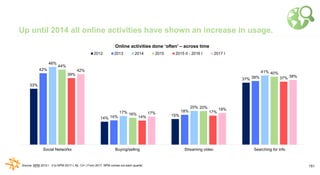

- 134. 134Source: Newcom, Dutch National Social Media Survey 2017, TA: 15+ WhatsApp and Facebook still show growth in usage. Highest increase for Instagram, slight decrease for Twitter. Social media usage

- 135. 135 Highest usage for WhatsApp and Facebook. Replacing Twitter, Instagram enters top 5. Main platforms: 3.2 million Dutch people use Instagram, 1.5 million use it daily 4.3 million Dutch people use LinkedIn, 0.4 million use it daily 7.5 million Dutch people use YouTube, 1.7 million use it daily 10.4 million Dutch people use Facebook, 7.5 million use it daily 10.9 million Dutch people use Whatsapp, 7.8 million use it daily Source: Newcom, Dutch National Social Media Survey 2017, TA: 15+ Other platforms: 0.1 million Dutch people use Foursquare , 46 K use it daily 0.1 million Dutch people use WeChat, 63 K use it daily 0.4 million Dutch people use Tumblr, 101 K use it daily 1.9 million Dutch people use SnapChat, 960 K use it daily 2.4 million Dutch people use Pinterest, 381 K use it daily 2.6 million Dutch people use Twitter, 871 K use it daily

- 136. 136 Snapchat and Tumblr are mainly used by younger age groups 10% 10% 8% 14% 10% 10% 28% 22% 24% 25% 27% 28% 27% 20% 35% 30% 27% 28% 29% 28% 29% 28% 23% 26% 25% 24% 26% 20% 24% 26% 10% 17% 14% 12% 11% 10% 10% 16% 3% Facebook Twitter LinkedIn Instagram Pinterest Google+ Snapchat Tumblr Age distribution of social networking sites in NL 13-19 20-34 35-49 50-64 65+ Source: GfK DAM, base: 13+, Q1 2017

- 137. 137 Facebook account ownership is stable at a high level. Active usage is again increasing after dip in 2014 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total 16+ 16-24 25-34 35-44 45-54 55-64 Account ownership 2012 2013 2014 2015 2016 2017 Q1 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total 16+ 16-24 25-34 35-44 45-54 55-64 Active users monthly 2012 2013 2014 2015 2016 2017 Q1 Source: GlobalWebIndex, 2012 – 2017 Q1, Base Internet Users NL16+,

- 138. 138 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total 16+ 16-24 25-34 35-44 45-54 55-64 Account ownership 2012 2013 2014 2015 2016 2017 Q1 Account ownership and usage of LinkedIn increases further after a slight decrease in 2015 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total 16+ 16-24 25-34 35-44 45-54 55-64 Active users monthly 2013 2014 2015 2016 2017 Q1 Source: GlobalWebIndex, 2012 – 2017 Q1, Base Internet Users NL16+,

- 139. 139 Strong increase for account ownership and activity of Instagram, for all age groups. 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total 16+ 16-24 25-34 35-44 45-54 55-64 Account ownership 2013 2014 2015 2016 2017 Q1 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total 16+ 16-24 25-34 35-44 45-54 55-64 Active users monthly 2013 2014 2015 2016 2017 Q1 Source: GlobalWebIndex, 2013 – 2017 Q1, Base Internet Users NL16+. Instagram data is available from 2013 Q2

- 140. 140 Account ownership of YouTube is further increasing, just like active usage which shows an uplift after 2014. 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total 16+ 16-24 25-34 35-44 45-54 55-64 Account ownership 2012 2013 2014 2015 2016 2017 Q1 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total 16+ 16-24 25-34 35-44 45-54 55-64 Active users monthly 2012 2013 2014 2015 2016 2017 Q1 Source: GlobalWebIndex, 2012 – 2017 Q1, Base Internet Users NL16+

- 141. 141 Social Media in The Netherlands: privacy concerns are still an issue Source: Newcom, Dutch National Social Media Survey 2017, TA: 15+ 66% is worried about their data being sold 54% is worried about their data in general 57% does not know if they can trust social media 17% has (a lot of) trust in social media

- 142. 142 Worries about privacy have slightly increased. Especially the older age groups are worried. 44% 48% 0% 10% 20% 30% 40% 50% 60% Worried Worries about privacy in The Netherlands 2016 2015 Source: Ruigrok NetPanel, Whats happening online 2016, 18+ n=1,239 26% 38% 51% 52% 42% 42% 35% 34% 28% 17% 12% 12% 3% 3% 1% 2% 0% 10% 20% 30% 40% 50% 60% Digital teenagers Millennials Generation X Babyboomers Worried about privacy Worried Neutral Not worried Don't know

- 143. 143 SURFING ONLINE

- 144. 144 Trends and developments – I E-commerce has increased with 16.5% in 2016. The Dutch online shopper is expected to spend €811 per person, which is an increase of €26.64 compared to 2015. E-commerce Source: http://www.marketingonline.nl/nieuws/e-commerce-groeit-dit-jaar-met-165 |http://www.nu.nl/internet/4339731/cookiewet-duur-en-beschermt-onvoldoende.html | https://www.emerce.nl/best- practice/youtube-begint-afscheid-cookies-pixels | https://radar.avrotros.nl/nieuws/detail/akkoord-over-roaming-binnen-eu/ Cookie law EU Telecom According to Actal, the much debated cookie law will disappear in the future. Just like in other EU countries, websites have to ask visitors for permission for the use of tracking cookies, but this is expensive and causes irritation. YouTube Pixels Youtube wants to decrease the use of cookies and pixels and will shift to ‘cloud based measurement’. The current technology of cookies is less effective because of the increasing cross device usage. That’s why data will be based on Google users in stead of Cookies. With this choice, Google makes a big step to ‘people based marketing’. From June 15th 2017, phone users will pay the same amount of money for roaming, texting and calling in every European country. According to the European Parliament this is a victory for the European Telecom consumer.

- 145. 145 Trends and developments – II Websites are struggling with ad blockers. The number of people who are installing ad blockers on desktop, tablet and phones is growing. Right now, 4,9% of all Internet users around the world are not seeing advertisements. In The Netherlands, this number is much higher (26%). For websites this is perceived to be a big problem as it decreases the value of online ads. Half of the Dutch population considers to install ad blockers. People have a positive attitude towards advertising in general, but are annoyed by online ads. The use of ad blockers is highest on laptops and desktops. However, the intention to install ad blockers is highest for smartphones. The popular ad-blocker website AdBlock Plus will give advertisers the opportunity to serve relevant and good ads. Advertisers and publishers can be on a ‘white list’ by paying a certain amount of money. Also, the ads itself can not be too irritating for users. Source: http://nos.nl/artikel/2056954-websites-worstelen-steeds-meer-met-adblockers.html | http://www.adformatie.nl/nieuws/onderzoek-adformatie-helft-nederlanders-wil-aan-de-adblocker I http://www.emerce.nl/nieuws/adblock-plus-gaat-zelf-advertenties-verkopen

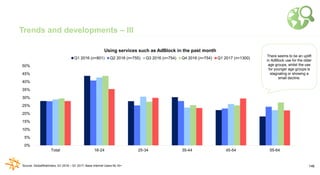

- 146. 146 Trends and developments – III 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Total 16-24 25-34 35-44 45-54 55-64 Using services such as AdBlock in the past month Q1 2016 (n=801) Q2 2016 (n=755) Q3 2016 (n=754) Q4 2016 (n=754) Q1 2017 (n=1300) Source: GlobalWebIndex, Q1 2016 – Q1 2017, Base Internet Users NL16+ There seems to be an uplift in AdBlock use for the older age groups, whilst the use for younger age groups is stagnating or showing a small decline.

- 147. 147 Trends and developments – IV DMA Institute is an international digital media auditing and quality assurance service empowering digital leaders and organizations in “Assessing The True Value Of Digital Media’’. With DMA you can measure the time for which the ads have been visible, which audience has seen the ad and which sites and placements provided conversions for the brand. Source: http://www.adformatie.nl/nieuws/dma-institute-begint-met-certificeren | DMAI Year End 2016 Visibility Benchmarks, January 2017. *In View: impression that has been in view for longer than 1 second. ** Quality View: an impression that has been in view for longer than 5 seconds. 0% 10% 20% 30% 40% 50% 60% 70% Q1 2016 Q2 2016 Q3 2016 Q4 2016 DMA visibility benchmarks In View* Quality View* Total 2016 In View: 59% Quality View: 41%